|

Forbearance programs permitting temporary suspension of Americans’ monthly mortgage payments have been a godsend to the more than 4 million borrowers who have made use of them in the time of COVID-19. But the end of this much needed grace period is looming large. Carol Faber, Partner and Co-Chair of the Distressed Property Practice at Akerman Law, has been through several downturns in her 35-year career. For Faber, it’s important to acknowledge that despite being five months into the COVID-19 crisis, the real estate cycle is still in the early stages of reacting to it. “No one really knows how long this is going to last,” she says. “I find myself repeating constantly that we are still in the early innings of this – even though we are five months in.” So far, Faber explains, neither lenders nor landlords have been able to enforce their rights, which has prevented the kind of dramatic mass-eviction scenario many tenants’ rights groups are fearing. The most important element in any sort of resolution will likely to be how the next phase of relief measures plays out. Faber does not anticipate government measures prohibiting foreclosures and evictions to expire according to their current schedules. “I don’t know that these programs are going away,” she says. “I think that Congress is going to re-up some of those programs so they won’t go away so fast. I don’t think they can let everything go into freefall. I don’t see how they cannot continue funding some of these programs – there is just too much demand for it right now.” Mortgage forbearance programs for borrowers with federally backed mortgages were scheduled to run until June 30, but that ending date has already been moved back to August 31. Once the government programs have run their course, Faber expects to see more foreclosures, sales of distressed properties, and perhaps a rude awakening regarding the value of loan portfolios. “Currently there is a disconnect between what people think their loan portfolios are worth and what buyers think they’re worth. We’re going to see more determination of what the values are right now. It’s hard to underwrite properties right now,” she says. Faber feels that the timelines attached to the government’s many support vehicles, reflective as they are of a long-since extinguished optimism around the federal government’s ability to manage the crisis, will need to change. “I think the hope was that we’d be further along in the pandemic, that we’d be opening up [the economy], which would lend itself to ramping down some of these programs,” she says. “But people and institutions and companies are still in need of these programs, and the government will continue to fund them.” As government programs extend into August, Kenon Chen, Clear Capital’s executive vice president of corporate strategy, is keeping a watchful eye on both foreclosures and forbearance numbers, noting that the default rate already climbed from two percent, 7.76 percent in May. “It’s concerning,” Chen says. “Once the moratorium is lifted there could be an impact. There are going to be loans that need decisions and [we will have ] to ascertain the value and conditions of these properties.” Chen is taking a wait and see approach, while also emphasizing the need for lenders and originators to be armed and ready with information if a wave of defaults hits. “We are seeing some recovery in housing, and the question remains what will it look like in fall and for the rest of the year? It’s difficult to predict. The one thing I think is clear is that in order to reduce risk, the need for low cost data and analytics is paramount to give lenders the opportunity to make good decisions,” he says.

0 Comments

Apartment landlords across the U.S. spent the last days of March holding their collective breath while waiting for rent checks to come in.

For the most part, they did, thanks to the $2 trillion in emergency relief authorized by Congress to blunt the economic blow of the pandemic. Now, expanded unemployment benefits are expiring and eviction bans are set to lift, leaving tenants and building owners wondering again what will happen when the bills are due. It’s not going to be good. One in three renters failed to make their full payment in the first week of July, an Apartment List survey showed. Nearly 12 million renters could be served with eviction notices in the next four months, according to an analysis by advisory firm Stout Risius Ross. And in some cities, like New York and Houston, more than a fifth of renters say they have “no confidence” in their ability to pay next month. “You’d have to go back to the Great Depression to find the kind of numbers we’re looking at right now,” said John Pollock, staff attorney at the Public Justice Center, a Baltimore nonprofit that uses legal tools to fight poverty. “There’s almost no precedent for this, which is why it’s so scary.” The pandemic spurred mass layoffs beginning in March, and renters have been scraping by on a combination of savings, credit card debt, unemployment benefits and federal stimulus. Roughly 11 million renters spend at least half of their income to keep a roof over their heads in normal times, and the first wave of job cuts skewed toward lower-paying retail and hospitality workers who are less likely to have emergency savings. One-time stimulus payments of $1,200 helped, as did eviction moratoriums passed by local, state and federal governments. And Congress authorized an additional $600 a week in unemployment insurance on top of what states provide, offering a lifeline to millions. In some cases, the benefits exceed what workers were bringing home while employed. That extra boost will expire at the end of the month without action by Congress. The Trump administration and Senate Republicans have yet to release their $1 trillion plan for another round of virus relief, which Treasury Secretary Steven Mnuchin and others have described as an extension of portions of the last stimulus. The proposal would be their opening bid in talks with Democrats, who’ve already offered a $3.5 trillion package. Continuing the extra unemployment benefits would provide a measure of relief to people like Brooke Martin, 33, who lost her job at a dive bar in Seattle in March. Even though the business has since reopened, she’s hesitant to go back, fearing for her own safety. The bar doesn’t have good ventilation and people aren’t wearing masks when they aren’t drinking, she said. Martin and her husband have been living off her unemployment alone, because he was unable to collect benefits himself. After her student loan payments, utilities and other expenses, the money is barely enough to cover their $1,800-a-month apartment. “As of the end of the month, we’re screwed,” she said. “There’s just no two ways about it.” The U.S. had a pretty “stingy” safety net when it came to housing before the pandemic, said Mary Cunningham, vice president of the Metropolitan Housing and Communities Policy Center at the Urban Institute. But Congress’s quick action to give aid this spring has shown the upside of being more generous. Adults who received unemployment benefits were far less likely to report they were worried about making rent or mortgage payments, compared to those who hadn’t gotten the relief, according to a survey the institute conducted in May. “This has been an important part of the safety net,” said Cunningham. “If Congress doesn’t do anything, I think we are in for a dark fall and winter.” John Pawlowski, a senior analyst at real estate research firm Green Street Advisors, said he doubts the apartment industry would see an immediate crash if the additional unemployment benefits aren’t extended. People will skip things like auto and credit card payments to cobble together enough for rent. “People still need a place to live,” he said. But over the long-term, rental revenue will decline because of missed payments and lower occupancy as tenants look to save money by doubling up with others, Pawlowski said. Landlords could end up missing more than $22 billion in rent over the next four months, according to the Stout analysis. Chuck Sheldon manages about 1,650 apartments in Albuquerque, New Mexico, about half of which he owns. Rent collections have been far better than he had feared in late March, when several states were going into lockdown. Sheldon’s T&C Management tends to rent to more blue-collar and service workers who have been disproportionately hit by job losses. Most have tried to stay current, he said, and the $600 unemployment boost has been a “huge” part of that. “When it drops off, that’s going to be painful,” he said. With more than 32 million people set to lose the additional $600 per week in unemployment benefits when the Federal Pandemic Unemployment Compensation (FPUC) program expires this week, the share of renters facing a severe housing-cost burden could skyrocket – with Black households disproportionately affected.

According to a new analysis by Zillow, the expanded unemployment benefits have had a marked impact on households suffering from the economic impact of the COVID-19 pandemic. While missed rent payments have grown – 12.4% of renter households paid no rent in the first two weeks of July – they haven’t grown as much as might be expected given record unemployment levels. Renters in the service industry actually had lower cost burdens when collecting all benefits available to them than they did prior to the pandemic, according to Zillow. And only 3% of renter households in high-risk jobs are severely cost-burdened if collecting all the available unemployment benefits. But those benefits are set to expire around the same time that many eviction moratoriums will end. With unemployment claims remaining twice as high as the worst week of the Great Recession, that has the potential to cause a wave of housing insecurity, Zillow said. “The boost to unemployment benefits from the federal government has played a crucial role on keeping renters afloat, and has helped insulate the rental market as a whole,” said Zillow economist Jeff Tucker. “The rate of missed rental payments hasn’t risen nearly as much as expected, and eviction moratoriums are keeping many of those unable to make payments in their homes. But those temporary measures are mostly expiring soon, so without some form of extension to the unemployment benefits boost or eviction moratoriums, we could see a widespread eviction crisis as summer turns to fall.” Among the most vulnerable are “contact-intensive” workers – those in jobs that require a high degree of face-to-face, physically close interaction, such as healthcare and service jobs. Contact-intensive workers have been especially vulnerable to both illness and job loss during the pandemic – and they’re present in about 28% of renter households. With the assistance provided by the government, only 3% of renter households with at least one contact-intensive earner and receiving all available benefits would spend more than half their income on rent. With the cessation of the benefits, however, 41% would spend more than half their income on rent. This also causes disparities among racial groups. Contact-intensive workers contribute 72% of household income in Black households, compared to 53% in white households, according to Zillow. The median income of Black households with a contact-intensive worker is 15% lower than the median income of similarly situated white households. “This means Black renters are more vulnerable to the widespread income loss prevalent in these industries,” Zillow said. New data from advocacy group ParentsTogether Action has found that American families are feeling more anxiety over their financial situations today than they were in April and May, the period previously thought to be the height of the COVID-19 pandemic.

ParentsTogether surveyed over 1,500 parents between June 28 and July 1. Their findings paint a grim picture of the realities the average American family has been forced to endure as the country’s response to the coronavirus pandemic has gone from confusing to stupid to desperate. Seventy percent of respondents say their families are struggling, a 12 percent increase since March and a rise of nine percent since April. Of those who believe they are eligible for unemployment, 60 percent have yet to receive any payments. Forty-five percent of families are either “somewhat worried” or “very concerned” about losing their homes once their states’ eviction bans expire. Only 56 percent of those polled said they were able to pay their rent or mortgage without cutting back on essentials like food and medicine. In April, that number was 59 percent. While a rapid reopening of the economy was meant to get Americans back to work, many of the parents surveyed lost income for reasons other than closed workplaces. Half of the respondents who reported a loss in income attributed it to sickness, needing to care for their children, or a fear of infecting themselves or others. No surprise, then, that many respondents support a scaling back of their state’s economic re-openings: 46 percent thought non-essential businesses should have remained closed longer; 70 percent think re-openings should be scaled back now that cases are on the rise. How will Congress respond? The most alarming finding was that 74 percent of those polled said they will have trouble paying for basics like rent and food without the extra unemployment benefits from the CARES Act. Those funds, which have been providing a $2,400 cushion to out-of-work Americans who have actually been receiving them, are set to expire on Friday barring further action on the part of Congress. On Wednesday, CNBC reported that Republicans are considering extending the unemployment insurance benefit, but in a greatly reduced capacity: $100 a week until the end of the year. Democrats hope to keep the UI benefit at $600 per week, at least until 2021. Justin Ruben, co-director of ParentsTogether, is urging Congress to put ideology aside and do what’s necessary to keep American families housed, fed, and in a position to get back on track once the pandemic is finally brought under control. “When families struggle, kids pay the price, and right now, families are drowning,” Ruben said. “And the re-openings haven’t helped. Unless Congress acts immediately, things will only get worse as the extra unemployment checks stop and evictions start. To protect kids, Congress needs to provide ongoing economic relief, a pause in evictions, and solutions to the childcare crisis.” Republicans are reportedly discussing a $1 trillion aid package that will include another round of direct payments for individuals and families. Senate Majority Leader Mitch McConnell has decided to introduce the Republican plan in bits and pieces rather than releasing it in its entirety, a move that will slow negotiations even further. “Republicans have had months to propose a plan for extending supercharged unemployment benefits, and they still have nothing to offer,” Ron Wyden, Senate Finance Committee Ranking Member, told NBC News on Wednesday. US house prices posted a drop in May – reflecting the early impact of the coronavirus shutdowns on the housing market in late March and throughout April.

House prices nationwide were 0.3% lower than in April but remained 4.9% higher than a year ago, according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). A decline in the number of transactions driving the HPI was the reason for the slight month-over-month drop in May, according to Lynn Fisher, deputy director of the division of research and statistics at FHFA. "The May HPI results are based on contracts for sale signed in late March and throughout April, which was a period when many states announced stay-at-home orders," Fisher said. "The number of transactions powering the FHFA HPI in May was down by just over 30% compared to a year ago, reflecting the early effects of COVID-19 shutdowns. Based on the rebound in mortgage applications for home purchases and pending home sales in May, we expect the number of transactions increased somewhat in June." On a seasonally adjusted basis, monthly house price changes for the nine census divisions varied from -1% in the New England division to +0.1% in the South Atlantic division. The 12-month changes were positive in all division, ranging from +3.7% in the New England division to +6.3% in the Mountain division. With the coronavirus pandemic far from over, millions of Americans continue to struggle under the weight of a recession.

Over 53% of mortgage borrowers reported some sort of income loss since the COVID-19 outbreak led to a nationwide economic shutdown, according to a LendingTree survey of more than 1,000 mortgage borrowers. When broken down by age groups, 61% of millennials faced income loss, followed by 57% of Gen X and around 37% of baby boomers. Although more than half of borrowers saw income losses, only 18% of mortgage borrowers have missed a mortgage payment since March 2020. Of those who have deferred paying bills, 5% were not in a mortgage forbearance plan with their lender, which allows a temporary reduction or suspension of monthly payments. Meanwhile, 82% of borrowers have continued to make payments – 22% of which are in a mortgage forbearance agreement. The survey showed that just 30% of mortgage borrowers have entered into a forbearance deal, while 12% are still negotiating the terms of their mortgage relief, and 2% were denied loan payment deferral. "The forbearance program is essential to maintaining the health of the housing market and supporting the economy," LendingTree Chief Economist Tendayi Kapfidze said. "Without it, millions of people would be at risk of losing their homes." While more than four in 10 borrowers in forbearance have an annual household income of at least $100,000, around 7% of those who applied for mortgage assistance but were denied were earning less than $25,000 in income. This is the highest denial rate among all income brackets, according to LendingTree. "Unfortunately, the response to the coronavirus crisis has been very poor; many layoffs that were temporary are beginning to become permanent, and the economy is likely to remain weak well into 2021," Kapfidze said. A new bill introduced to Congress this week aims to help first-time home buyers purchase a home during and after the recovery from the COVID-19 crisis. The First Time Homebuyer Pandemic Savings Act, introduced by Rep. Sean Patrick Maloney (D-N.Y.), would allow first-time home buyers to withdraw funds from their retirement accounts under the umbrella of COVID-19-related distributions to help with the purchase of a home. Under the bill, up to $25,000 of the coronavirus-related distributions would be tax-exempt and penalty-free if put toward a down payment for a home. “Making sure the next generation of homeowners have the resources they need to buy their first home is going to play a big role in our economic recovery,” Maloney said. “This bill is a smart, innovative way to bring new opportunity to new home buyers and help young families get one step closer to realizing the American dream.” The bill has gotten the thumbs-up from the National Association of Realtors, which has called on members of the House of Representatives to co-sponsor and support it. “While various barriers have stood in the way of homeownership for younger generations, COVID-19 has pushed the American dream further out of reach for countless families and individuals by no fault of their own,” said Vince Malta, president of NAR. “This legislation would make a tremendous difference to those struggling to save for the down payment on their all-important first home. With homeownership remaining one of the best and most sustainable ways for Americans to build wealth, the nation’s 1.4 million realtors applaud Rep. Maloney for his leadership.” Courtney Jones, a Chicago real estate agent and developer, has the perfect analogy for racial inequity in modern-day real estate: Picture a game of Monopoly, and then imagine that your opponent got to circle the board 400 times before you were allowed to play.

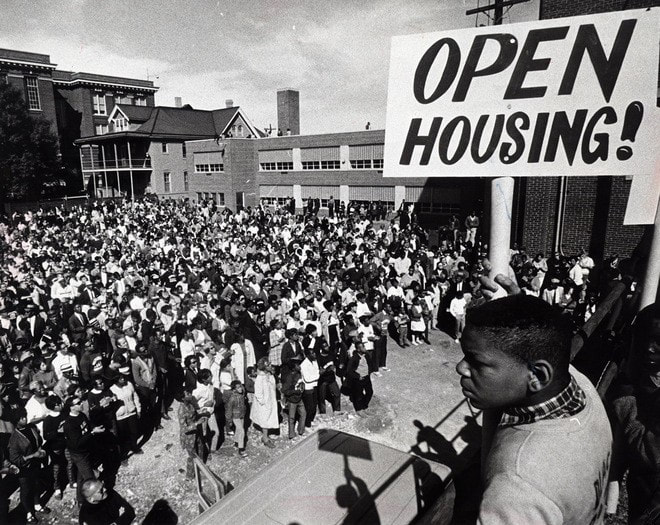

“How much would that affect your ability to be successful at the game?” he said. Black people have been treated inequitably when it comes to the American dream of homeownership, as ugly practices like redlining, segregation and, to this day, inequity in lending prevent them from having the same opportunities as their white counterparts. As the country’s attention has turned to systemic racism following George Floyd’s death and nationwide protests calling for action, the movement is sparking conversations in the Chicago-area real estate industry about the need for change. “It’s just time to assist the rest of mainstream white America to really become conscious of what its brethren have been dealing with,” Jones said. “Just because the shackles aren’t physically on people’s wrists and neck doesn’t mean it’s really a level playing field in the socioeconomic space.” There are encouraging signs of progress in the real estate sector: This year, the Chicago Association of Realtors elected the first Black female president in its 137-year history, while Jones is the city’s first Black “receiver” of a downtown high-rise as part of a city program in which developers are hand-picked to rehabilitate buildings seized by the government over, for instance, building code violations. Courtney Jones, president of the Dearborn Realtists Board, an organization focused on eradicating racist practices from Chicago real estate, stands outside one of his listings, the Pittsfield Building at 55 E. Washington St. on July 6, 2020, in Chicago. (Erin Hooley / Chicago Tribune)But equality seems a long way away. Change is needed in lending practices, equitable building across neighborhoods and investment in communities where the effects of redlining and other discriminatory practices linger, Black industry leaders say. But, they add, they cannot shoulder the burden alone. “You cannot sit on the sidelines,” said Nykea Pippion McGriff, president-elect of the Chicago Association of Realtors. “You have to be a player to change the game.” The most recent debate centers on removing the term “master” from listings when describing a home’s largest, primary bedroom or suite because of the word’s association with slavery. Houston Realtors was among the first to make the move in late June, and the issue has been raised in Louisville, Kentucky, Washington, D.C., and here in Chicago. Local brokerage @properties told its employees at the end of June that it would phase it out of company materials. “It seemed like a very obvious, easy thing to do,” said @properties co-founder Thad Wong. “I don’t think changing this word is going to change systemic racism in our society. But if it’s a word that is negative for any group, I don’t know why we wouldn’t put effort into changing it.” At the state level, Illinois Realtors follows U.S. Department of Housing and Urban Development guidance, “which says the term is not discriminatory,” said Illinois Realtors spokesman Anthony Hebron. The Chicago Association of Realtors said it “support(s) inclusive language” and its board members are discussing the issue. Same goes for the Midwest Real Estate Data (MRED), the Lisle-based multiple listing service that serves much of the Chicago area, a spokesman said. Dearborn Realtists, the country’s oldest African American real estate trade association formed in 1941 in Chicago, is set to discuss the topic at its next board meeting, said Jones, the association’s board president, who also co-owns Chicago Homes Realty Group & Property Management and serves as executive director of the nonprofit Black Coalition for Housing. “A lot of negative history is attached to that word,” Jones said. “The subliminal messaging just continues to perpetuate a message of inferiority, or submission.” But adjusting language can only go so far, said Pippion McGriff, who is also a broker with DreamTown. “I think at this point, we’re beyond words,” she said. “We need more specific action. Personally, I think it’s a Band-Aid.” Pippion McGriff got into the real estate business 15 years ago after buying her first home. Learning about grants and other funding options she’d never heard of proved an eye-opening experience. Realtor Nykea Pippion McGriff wears a face mask to mitigate the spread of COVID-19 as she turns off a stairwell light while showing a home in the Avondale neighborhood May 2, 2020, in Chicago. (John J. Kim / Chicago Tribune)So was seeing discrimination firsthand against buyers with federal housing choice vouchers; five years ago, Pippion McGriff had clients with a voucher looking for a three-bedroom home in the South Loop or Loop who were repeatedly turned down with no explanation. “Brokers look for ways to circumvent it, but they need to learn that source of income is a protected class,” she said. “The first question was, ‘Is this Section 8?’ Well, yes, and it’s also a protected class with pretty much guaranteed income for your client. But I was unable to find them a property in the area they wanted to be in. It was completely disheartening.” It’s not enough, either, to simply treat everyone the same now, industry leaders said — Black people are still too many laps behind on the metaphorical Monopoly board. “We talk a lot about gentrification and the result of that, but the communities need more access to capital,” Pippion McGriff said. Loans for rehabbing blighted properties, alternative lines of credit, and funds for first-time home buyers are key areas where investment is needed, she said. Changes in lending practices based on factors like credit scores and risk calculations — with the consequence often being a Black family paying more for the same loan because they’re considered a riskier borrower — would give disadvantaged borrowers a fair shake, Jones said. “A clean slate, to me, would mean everybody has access to capital at the same cost,” Jones said. But that’ll be difficult in a post-pandemic world, where spikes in unemployment have lenders changing guidelines or requiring more money for a down payment, said Sheila Dantzler, a real estate agent with Jameson Sotheby’s International Realty who also builds and rehabs buildings in her Bronzeville neighborhood. While the percent difference might seem small, the cost of a higher-interest loan over its decades-long term could come at the expense of college tuition, retirement savings or other means of increasing wealth. When the pattern repeats across generations, the loss only grows. Over the past four decades, the median home in redlined neighborhoods in Chicago netted $232,000 less in home equity — about half what the median home in greenlined neighborhoods gained, according to a June report from real estate brokerage Redfin. “If society cares about all of its members, then it’s important we push for this proportionate economic benefit for Black people to be made whole,” Jones said. “We’ve seen restitutions and reparations for different cultures because of the heinous things those people have been subjected to; and we’re the last who haven’t received that.” Tougher enforcement of fair housing laws, coupled with education on what discriminatory practices entail, would go a long way. NAR has already ruled that secretive “pocket listings” — homes kept close-to-the-chest, off the market and offered only to a choice few — should not be allowed, seeking to level access to top listings. The city has made solid strides with efforts like the Neighborhood Opportunity Fund and Mayor Lori Lightfoot’s Invest South/West initiative — which is meant to pump $1 billion from city agencies, private investors and tax-increment funding into 10 Chicago neighborhoods in three years. Dantzler was one of five builders selected for the 3rd Ward Parade of Homes initiative, which used city-owned lots to build 42 single-family homes with high-end finishes in Bronzeville over the past three years. “But often, it takes a really long time, and there’s a high barrier to get into it,” Dantzler said of the city-funded programs. “If it’s city land, they want environmental tests and appraisals, which can cost thousands of dollars before you even get approved and take up to a year before you even start.” Real estate agent Sheila Dantzler stands in her under-construction salon July 12, 2020, in the Bronzeville neighborhood of Chicago. (Erin Hooley / Chicago Tribune)Real estate firms should also reexamine their own methods of tracking agents’ success to encourage buying and selling in lower-income neighborhoods, Dantzler said. If brokers are judged on the total dollar amount of their sales, an agent who sells 25 homes in pricier North Side neighborhoods will outrank one who sells 25 homes on the South and West sides. “We can’t abandon our communities and go somewhere else to try and make more money, but we’re doing the same amount of work,” Dantzler said of South Side real estate agents. “I’ve lived here, my parents lived here. These are my neighbors.” The industry also needs to take a hard look at who is leading it, Pippion McGriff said. “There is a lack of diversity in upper levels of leadership,” she said. “Look at how brokerages are attracting and promoting talent. Diversify your network. Those are very specific actions you need to take in addition to changing wording on a listing.” The Chicago Association of Realtors has scholarships for people of color who want to study real estate or further their education, and it is also working on initiatives like The 77, a diversity committee with a member from every Chicago neighborhood focused on fair housing and economic development. It’s just one way for allies to join in the fight, Pippion McGriff said. “Figure out what’s happening in all the different communities that you may not sell in as a Realtor,” she said. “But you’re a Chicago broker, so you should have a certain knowledge of what’s happening in the city.” There are other signs of progress, like Jones’ receivership. He was chosen as part of a city program to fix the lower half of the Pittsfield Building in the Loop, repairing its crumbling facade, replacing windows and making other cosmetic changes. Dearborn Realtists began working with the city in 2017 to train more Black developers and mom-and-pop investors in the receivership process, opening up opportunities for 330 recruits, Jones said. But real estate is just one factor in a system in need of a larger overhaul. Families often decide where to live based on the quality of nearby schools and the level of violent crime, Dantzler said. Better schools will draw more buyers to neighborhoods and give children better opportunities that provide an alternative to a cycle of violence that has plagued disinvested communities for generations, she said. “Where schools aren’t good, parents don’t feel safe sending their kids there, so they move out of the neighborhood,” she said. “And then you have neighborhoods that are somewhat abandoned and just never able to rebound. That translates into property values and appraisals.” She and her husband strive to make their community better, building new homes and, most recently, renovating a commercial building with the hopes of bringing more retail to Bronzeville. She recognizes that it’s important to keep the community affordable for the people who have lived there many years, but to her, vacant lots help no one. “The motto for our business is improving the neighborhood one vacant lot at a time,” she said. Still, they face setbacks that developers on the North Side don’t. While it costs the same to build a home in Bronzeville as it does in pricier areas like neighboring Hyde Park, the sale price is far less, Dantzler said. With lower margins, lending guidelines are tighter. “They think, ‘I could build the same house 5 miles up and triple my profit,‘” she said. “So it’s hard to find committed developers.” Still, there’s a sense going around that maybe, just maybe, the time for real change has come. “There’s a lot of tension, and I think we have to remember we’re all in this together,” Pippion McGriff said. “It’s one human race, acknowledging the problem and working together for a solution to provide equity to all members of our city.” As homeowners rethink their surroundings and rush to relocate, companies are offering creative ways to help ease a fraught process.

Working from home during the pandemic prompted Dan Feder to consider moving his family to another Los Angeles neighborhood to be closer to his son’s school. Dan Feder, a graphic designer, and his husband, Don Bacigalupi, a museum director, have lived in the Hancock Park neighborhood of Los Angeles for two years. But they started looking to move closer to their teenage son’s school when pandemic lockdowns showed they could avoid a commute across town by working from home. Yet having moved from Chicago two years ago, they still felt that they had an outsider’s view of Southern California real estate. They worried, too, about making a mistake in an uncertain economy. “With so many unknown variables in the world, we wanted as much information as we could get before moving forward with such a large financial decision,” Mr. Feder said. “As an outsider, it’s difficult to gauge that.” Buying a home under any circumstances can be stressful. But with some buyers looking to improve their lives during the pandemic and others trying to flee congested cities for greater space in the suburbs, the rush to move could cause unexpected problems. Companies are coming up with creative ways to help ease the process. The financial aspect alone is daunting in this economy. Down payments on a home can be 25 percent to 30 percent of the purchase price, money that becomes largely untouchable once it’s handed over. But there are other factors to consider. Carrying costs are one, but so is the nature of a home as an asset: It may be worth millions of dollars on Zillow, but selling it for that price can be difficult. The pandemic has created interrelated dynamics that make the process more complex. Some buyers want out of their city apartments, having already been cooped up in them for months this winter. If they have children, they may be acting quickly to get settled before the school year starts. Existing-home sales in the United States fell 26.6 percent in May from a year earlier, to 3.9 million, according to the National Association of Realtors, but the pandemic has been a catalyst for many to move, with suburban areas drawing more interest, according to a separate report from the Realtor group. For example, the median sale price of a home in New Canaan, Conn., which is within commuting distance of Manhattan, rose 29 percent in May from the year before. The national average interest rate on 30-year fixed mortgages fell below 3 percent for the first time on record this week, which could spur more people to buy a home. There are deals in cities for those with cash and a strong stomach. Some of those purchases, costing millions of dollars, have been made through online scrolling and Zoom walk-throughs. But when purchases are driven by video, what catches the eye sells, and flaws can be missed. “While various video technologies are changing how we travel and what we need to see live, I would not advise nor endorse buying any real estate sight unseen,” said Bill Nimmo, who heads the real estate asset management group at Wells Fargo Private Bank. “It can make sense to put a property under contract before visually seeing it, but not to close on it without seeing it live.” He pointed to the ineffable feeling of home, from the light and flow to the neighbors. “These are subjective things that most buyers should see and experience to make a major investment,” Mr. Nimmo said. A residential tower under construction in Lower Manhattan, 130 William, is open for virtual tours. The risk of buying anything sight unseen is unavoidable with a project under development. During the stay-at-home order in New York, 10 buyers purchased luxury condos for $2 million to $6 million at an unfinished development, 130 William, in the financial district. Buyers usually get to peruse a high-end show room, to touch finishes and see how kitchens and bathrooms will be laid out. But in this case, they relied on online material, created for each apartment, down to the view from the windows. “The shutdown worked to our advantage,” said Scott J. Avram, a senior vice president at Lightstone, the developer of 130 William. “It turned out to be a good bet to push more advertising. Buyers were almost a captive audience.” Some were persuaded to buy because they could put down a 10 percent deposit, lock in a low-interest mortgage but not have to close until the fall, when the building will be finished. How people are doing their due diligence in this stressful time is as distinct as this moment in history. Some are trying to do traditional due diligence through new services. This was the case with Mr. Feder. Last year, he fell in love with a neighborhood on the west side of Los Angeles only to watch flames engulf it in last season’s wildfires. “We watched half the neighborhood burn up,” he said. “We have a large art collection, and we didn’t want to put that at risk.” So in the pandemic, he turned to a new product offered by PURE Insurance called Home Spotlight. The report rates a home’s risk for natural disasters like flooding, hurricanes, earthquakes and wildfires, and it is meant to show buyers whether PURE would insure the home. Not getting home insurance through a commercial carrier like PURE, AIG or Chubb substantially increases the annual premiums. But the report also details any insurance claims, construction permits and work done on the home that could point to other problems that are not apparent at first glance — and certainly not through a video tour. “If the buyers haven’t been given full disclosure, which is the law in California, then it causes other questions to come up,” said Steven Brown, chief executive of Hoffman Brown, an insurance brokerage firm. “If you didn’t tell me about the toilet that overflowed and cost $100,000 to fix, what else didn’t you tell us about?” The report keeps the seller honest; it also slows down a buyer who may be acting quickly without full information. A different type of fear — fear of missing out — is driving buyers who see opportunities as city dwellers flee to the suburbs. Christopher Rim, founder and chief executive of Command Education, an education consultant in New York, said he had started getting unsolicited offers for the TriBeCa loft that he bought less than a year ago. The offers were for more than the $3 million he paid. “I figured if I could score a deal on another apartment, it would be a good trade,” he said. He began looking for a bigger condo in a less-desirable neighborhood where prices were cheaper, figuring he would be working from home for the foreseeable future. But when his lowball offer of $3.5 million offer on a condo listed for $4.8 million was accepted, Mr. Rim paused. He worried about getting swept up in the moment. Now his plan is to be more strategic and wait until the fall, when he is betting people who have left the city will discount their apartments even further. “There’s no way school is happening this fall,” he said. “They’re going to want to offload some inventory.” In addition to viewing real estate, closing on a property has become more complicated and time consuming when social distancing is required. No longer are a dozen people crammed into a law office conference room to watch a buyer sign a stack of legal documents. But remote closings actually require greater vigilance and time to ensure mistakes are not made. “When you’re face to face with a client, you’re able to go over all the numbers with them and make sure what they’re signing at the closing is what they negotiated,” said Sal Strazzullo, a real estate and estate planning lawyer at Strazzullo Law. “Being on the phone with someone and having them sign the documents when you read through them — you have to step up your game.” He said closings that normally took an hour and a half could stretch on for 48 hours or more. Recently, he had to amend a closing when money wired to buy a condo arrived four days late. Mr. Feder has not found another house in Los Angeles yet, but he and his husband have bought a weekend home in Palm Springs. They used their insurer’s home spotlight to assess the renovations that had been done to it. “It stood out for its cleanliness, but we saw permits that were pulled for work on the home,” he said. In this case, the renovations were purely for aesthetic reasons, but Mr. Feder felt comfort having the additional background. “This is a very uncertain age, and there’s a part of you that says, ‘Are we crazy for making a real estate purchase now?’” he said. “But if you can be confident and move forward, that’s better.” Redfin is the latest real-estate company to jump back into the iBuying game after a coronavirus-related shutdown.

The Seattle-based brokerage said Thursday that its RedfinNow segment, which provides instant offers to home sellers to purchase their properties, would resume home-buying activities. In doing so, Redfin joins fellow iBuyers Opendoor and Offerpad in re-entering the housing market. Zillow also said Thursday that it would slowly relaunch its iBuying arm, Zillow Offers, in the coming weeks. So-called iBuyers represent a small but growing share of the overall real-estate market. Nearly 7% of homes sold in Raleigh in the third quarter of 2019 were bought by iBuyers, according to a December report from Redfin, more than any other market nationwide. Despite the coronavirus outbreak causing a downturn in home sales and listing activity through March and April, Redfin managed to beat expectations with its first quarter earnings as the company posted a net loss of $60 million. A year ago, Redfin had reported a larger net loss of $67 million, for comparison. The company’s CEO, Glenn Kelman, has said that the company’s tech offerings — including virtual home tours and open houses — will help it weather the pandemic. But while signs are starting to emerge that Americans may begin to re-enter the housing market, the speed of the recovery is far from certain. Fannie Mae reported that consumer confidence in housing had fallen to the lowest level since November 2011. It was a harrowing couple of months. We had to ensure that the homes we had bought before the pandemic could still be sold once the pandemic had started, and you just can’t forget that easily. So instead, you just lower your offers a little bit, and that gives you some leeway.MarketWatch spoke with Kelman ahead of Redfin’s earnings release to discuss how the pandemic has affected the U.S. housing market and what will change about iBuying in the wake of COVID-19. MarketWatch: Redfin has announced that the company’s iBuying division, RedfinNow, will resume operations following the coronavirus-related pause. What drove that decision? Glenn Kelman: The reason we’re reopening it is because we think it’s a reasonably good time to own a house. Inventory is down 25% year-over-year, and home-buying demand is almost back to pre-pandemic levels. So we’re willing to take a risk again. I think we’ll lower the amount we’re willing to pay for a house, just to give ourselves more margin for error. MW: Is RedfinNow introducing any new procedures because of the coronavirus pandemic? Kelman: I feel like what’s changed about our approach in iBuying specifically is just more about margin. You always knew that you had to have a margin for error — that there was a possibility of a downturn and that every offer you made had to account for that. But it’s another thing to actually go through that. So I think there will be more margin for error, but also less tolerance for a real project. If it’s a piece of work and it’s going to take six months to get it back on the market, you just can’t wait that long to figure out if you offered the right price to the homeowner. The market could change. MW: Do you think that the pandemic could make iBuying more popular, since it eliminates a lot of the in-person interactions the home-buying process typically requires? Kelman: That wouldn’t be my guess. The homeowner who might be more anxious to sell their home, we’re going to find out whether more of them take offers in the next few weeks. But the other part you have to consider is the money man. The people who are providing capital for iBuyers may have a different appetite for risk on the other side of this. If iBuyers all come into the market at the exact same margin they were at two or three months ago, I think our acceptance rates are going to be really high. But my guess is that they’re going to price the risk into their offers. And I don’t know how consumers are going to react. When we make offers, if we give ourselves just a little more room for all the risks that we’re taking, will people still accept it? ‘It used to be that working class folks could reasonably aspire to buy a house. And now I think buying a house has really become a privilege.’— Glenn Kelman, CEO of Redfin MW: You mentioned earlier that there’s been a resurgence in home-buying demand — what is driving that? Kelman: Probably the bifurcation of the American dream. It used to be that working-class folks could reasonably aspire to buy a house. And now I think buying a house has really become a privilege, and the privileged class is doing better in this pandemic than the people who work in restaurants and perform other in-person services. So unemployment is going to be bad for one part of America; for another part, it isn’t as bad. And so that’s the part that’s buying a house. And maybe the other dimension of this is just that there’s been an affordability crisis for so long. There’s structural reasons that there aren’t enough homes for enough homes in America. There is just a large number of people who have been trying to buy a house for two, three, four years, especially in really expensive markets. And if this pandemic is an opportunity to do that, with less competition, you’re going to take it. MW: What’s your take on the state of secondary markets and vacation markets right now? Kelman: Toast. Those are going to be in tough shape. There’s a whole economy that was built around the liquidity there that Airbnb provided. You could get pretty deep into debt and still have somebody pay your mortgage every month because Airbnb and other travel websites were so good at finding someone to rent it out. And I don’t think many of those folks have the reserves that Marriott or that Hilton does. Investors who own Airbnb properties are looking for immediate liquidity. At some level it’s Redfin, Zillow and Opendoor picking up where Airbnb left off. If they can’t get cash flow through one website, they’ve got to sell it through the other. ‘There’s a whole economy that was built around the liquidity there that Airbnb provided.’ — Glenn Kelman MW: Some have suggested that the coronavirus pandemic could lead to a migration out of major cities, especially ones like New York that were hit hard by the outbreak. What’s your take on this? Kelman: It’s on like Donkey Kong. There’s going to be a major move. That was already underway just because of the affordability crisis. People are leaving New York for Philadelphia and are leaving San Francisco for Sacramento and even Phoenix. Seattle was starting to lose people to Tacoma, which is just down the street. I think some of it is about consumer wariness where we’re living in close quarters with other people. But most of it’s about employer flexibility. Employers that were really stuck on whether to let people work from home have gotten completely unstuck. And if you can work for Goldman Sachs, but not in New York, if you can work for Amazon, but not in Seattle, well, why would you pay the premium? |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media