|

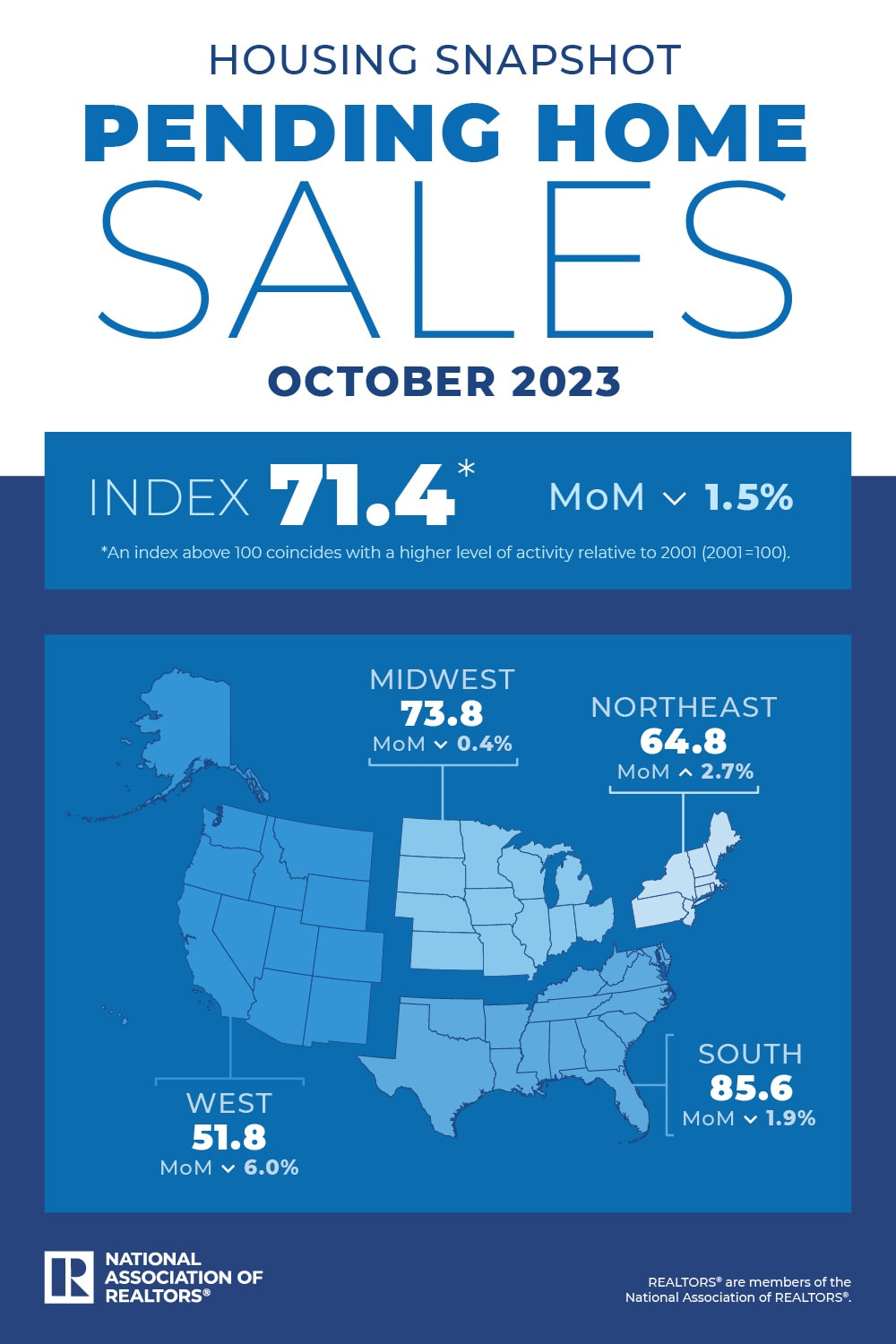

Mortgage rate surge triggers historic drop in pending sales in October. With mortgage rates going off the charts, pending home sales fell to their lowest level in over two decades, according to the National Association of Realtors (NAR). The number of contract signings for existing homes dropped 1.5% month over month and 8.5% year over year in October, bringing NAR's Pending Home Sales Index (PHSI) to 71.4 – the lowest since the trade association began keeping records in 2001. Housing industry experts attributed this slump to October's peak mortgage rates.

"During October, mortgage rates were at their highest, and contract signings for existing homes were at their lowest in more than 20 years," NAR chief economist Lawrence Yun said in the PHSI report. "Buyers and sellers are very mortgage-rate sensitive. Higher mortgage rates have had a dual impact on the housing market – reducing affordability for potential buyers and keeping sellers rate-locked in," said Odeta Kushi, deputy chief economist for First American. Kate Wood, home and mortgage expert at NerdWallet, said the decline in pending sales may reverse as mortgage rates eased off throughout November. "But given that inventory levels remain low and the real estate market generally slows heading into the holidays, pending home sales might not bounce right back from this low point," Wood noted. "While there remains quite a bit of demand for homes on the sidelines, you can't buy what's not for sale, even if you can afford it," Kushi added. "Home sales are rising in places where more inventory is available," Yun said. "Sales for properties priced above $750,000 were higher than a year ago because there is more inventory at this price point than what we saw last October. Additionally, newly built home sales are up 4.5% year-to-date due to homebuilders' ability to create more inventory. It is vital that we continue to focus on boosting housing supply by all means in all corners of the country over the coming months." The regional breakdown of the PHSI presented a mixed picture. The Northeast experienced a 2.7% increase to 64.8 but still fell 6.5% from October 2022. The Midwest saw a slight 0.4% contraction to 73.8, a 10.3% drop year-over-year. The South's index declined 1.9% to 85.6, down 7.1% from the previous year, while the West faced a sharper 6.0% decline to 51.8, a 10.8% decrease from October 2022. "Buyers continue to struggle with low inventory and affordability in many markets," said Keller Williams chief economist Ruben Gonzales. "Inventory levels are showing signs of increasing, but this varies by region. The Gulf Coast and Mountain West regions have the highest inventory levels, and the Northeast currently has the lowest. This year's pause in price growth created a window of opportunity for buyers with cash or large down payments, but that window now appears to be closing."

0 Comments

Fines will go into relief fund.

Bank of America Corp. agreed to pay $12 million in fines for submitting false mortgage-lending information to the US government, regulators said. From early 2016 through late 2020, some of the bank’s loan officers failed to ask mortgage applicants for their race, ethnicity and sex, as required under federal law, and then falsely recorded that the customers declined to provide the information, the Consumer Financial Protection Bureau said in a statement Tuesday. The fines will go into the bureau’s victim-relief fund, according to a consent order. “Bank of America violated a federal law that thousands of mortgage lenders have routinely followed for decades,” CFPB Director Rohit Chopra said in the statement. “It is illegal to report false information to federal regulators, and we will be taking additional steps to ensure that Bank of America stops breaking the law.” Bank of America, the second-largest US bank by assets, said in an emailed statement that it “properly collected demographic data in more than 99% of applications in the years reviewed by the CFPB and consistently had lower percentages of applicants not disclosing their race compared to annual industry averages.” After receiving one complaint in 2020, Bank of America conducted a review and notified the government, which prompted the inquiry from regulators, the Charlotte North Carolina-based lender said. It then took “additional steps in 2020 and 2021 to enhance our monitoring and training to ensure employees ask applicants for required racial, ethnic and gender information,” the bank said in the statement, noting that the data collection issue had no impact on applications. The company didn’t admit to or deny the allegations as part of the settlement. The regulatory penalty from the CFPB follows a recent $250 million fine in July over extra fees and unauthorized costs to consumers. A year earlier, the lender was fined $225 million for unfair and deceptive practices related to a prepaid-card program to distribute unemployment insurance and other public-benefit payments during the pandemic. It was also ordered last year to pay a $10 million penalty and repay fees that the lender charged customers when garnishing wages. As of June, Bank of America was the nation’s 17th-largest home-loan provider in terms of volume, according to Inside Mortgage Finance data. The CFPB has targeted a bevy of other mortgage lenders in enforcement actions involving alleged errors in data reporting. The agency sued Freedom Mortgage Corp. in October, alleging the home-loan originator and servicer intentionally misreported mortgage data. The agency uses annually submitted Home Mortgage Disclosure Act data on the race, income and other demographics of home-loan applicants to monitor mortgage providers for discrimination. Much of the data is also made publicly available. Sales saw their biggest slump for 13 years.

Sales of previously occupied homes in the US plunged in October, with rising borrowing costs and still-high prices contributing to the slowest pace of activity for over 13 years. Last month’s sales figures for existing homes were down 14.6% compared with the same time in 2022, and by 4.1% on a monthly basis to a seasonally adjusted annual rate of 3.79 million, according to the National Association of Realtors (NAR). The results missed analyst expectations, with economists on average having anticipated a clip of 3.9 million seasonally adjusted sales, according to FactSet. October’s figures mean sales have now dropped for five months in a row as prices continue to tick upwards despite the market cooldown. The median price of an existing home was up 3.4% on a year-over-year basis to $391,800, the NAR said, marking the fourth month in a row that prices have increased compared with a year prior. The Northeast, South, and West all recorded existing-homes sales declines, according to the NAR, although sales were unchanged in the Midwest. Economist weighs in on latest figures Lawrence Yun, the NAR’s chief economist, said a lack of supply and higher mortgages rates were the chief factors behind plummeting sales activity, with the 30-year mortgage seeing a weekly average rate of 7.79% in October. “Prospective homebuyers experienced another difficult month due to the persistent lack of housing inventory and the highest mortgage rates in a generation,” Yun said. “Multiple offers, however, are still occurring, especially on starter and mid-priced homes, even as price concessions are happening in the upper end of the market.” First-time homebuyers continue to account for a significant portion of sales, with 28% of existing-home purchases made by new buyers in October, the NAR said. Individual investors or second-home buyers bought 15% of homes last month, a drop from 18% the month prior. Foreclosures and short sales, also known as distressed sales, were effectively unchanged on a month-over-month basis, hovering at the 2% mark. Still, Yun saw some cause for optimism in the slight decline in mortgage rates in recent weeks, even though they remain high compared with 2022. He said an increase in supply in the months ahead could also prove a boost to prospective buyers. “Fortunately, mortgage rates have fallen for the third straight week, stirring up buying interest,” he said. “Though limited now, expect housing inventory to improve after this winter and heading into the spring. More inventory will result in more home sales.” Real estate franchisor denies any wrongdoing in high-profile class action lawsuit.

Real estate franchisor RE/MAX has secured preliminary approval from a Missouri court for a settlement in high-profile class action lawsuits involving claims around commission-sharing structures. On October 5, RE/MAX agreed to a settlement involving a $55 million payment and changes to its business operations. This agreement aims to resolve the pending litigation and avoid the uncertainties and costs associated with protracted legal battles. Despite agreeing to the settlement, the firm continued to deny any wrongdoing as alleged in the lawsuits. This lawsuit is part of a larger legal issue in the industry, highlighted by a commission collusion case involving the National Association of Realtors (NAR). The suit scrutinizes the standard commission model in real estate transactions, alleging that it leads to inflated costs for sellers and stifles market competition. It argues that NAR’s policies effectively force sellers to bear the buyer’s commission, raising concerns about the fairness and competitive nature of the industry. “We are pleased with the court’s decision to grant preliminary approval of the settlement,” RE/MAX president and CEO Nick Bailey said in a statement. “This development signifies progress in our ongoing efforts and commitment to a resolution – it’s a positive step forward in bringing these cases closer to the finish line.” RE/MAX said it has already started the process of paying the agreed sum, with full completion expected following the court’s final approval. Once finalized, the settlement will shield all US RE/MAX affiliates, including franchisees and agents, from claims associated with the lawsuits and similar claims, it outlined. The final court decision is expected next year, and RE/MAX will have to implement the agreed-upon business changes within six months of that date. Despite the substantial financial implication of the $55 million payment, RE/MAX does not foresee a significant impact on its financial performance or cash flow. Office mortgage delinquency rates are now higher than those of retail properties.

Mortgage delinquency rates for commercial and multifamily properties rose for the fourth consecutive quarter, with office delinquencies driving the increase in the third quarter. The early delinquency rate inched up four basis points to 97.3% at the end of the third quarter, according to the Mortgage Bankers Association’s recent Commercial Real Estate Finance (CREF) Loan Performance Survey. Loans that were 90+ days delinquent, or in REO, rose to 2.2%, up from 1.7% in the previous quarter. Jamie Woodwell, MBA’s head of commercial real estate research, pointed to a notable shift in the market, highlighting that: “The delinquency rate for loans backed by office properties now exceeds those of loans backed by retail and hotel properties.” Office property loans saw another uptick in Q3, with 5.1% being delinquent, up from 4% in the last quarter. Retail loan delinquency was 5%, a slight increase from 4.9%, while lodging loans decreased to 4.9% from 5.3%. According to Woodwell, a silver lining is that delinquency rates for multifamily and industrial property loans are still under the 1% mark. Multifamily balances had a 0.9% delinquency rate, up from 0.7%. Industrial property loans saw a decrease in delinquency to 0.6% from 0.8%. Woodwell further elaborated on the challenges the commercial property markets are grappling with. “Commercial property markets are working through challenges stemming from uncertainty about some properties’ fundamentals, a lack of transparency into where current property values are, and higher and volatile interest rates,” he said in MBA’s report. This combination of factors has led to a “slow and steady uptick in delinquency rates, concentrated among loans facing more of those challenges.” When it comes to capital sources, CMBS loan delinquency rates stood out with the highest levels at 4.4%, up from 4.1% in the last quarter. In contrast, non-current rates for other capital sources remained relatively moderate:

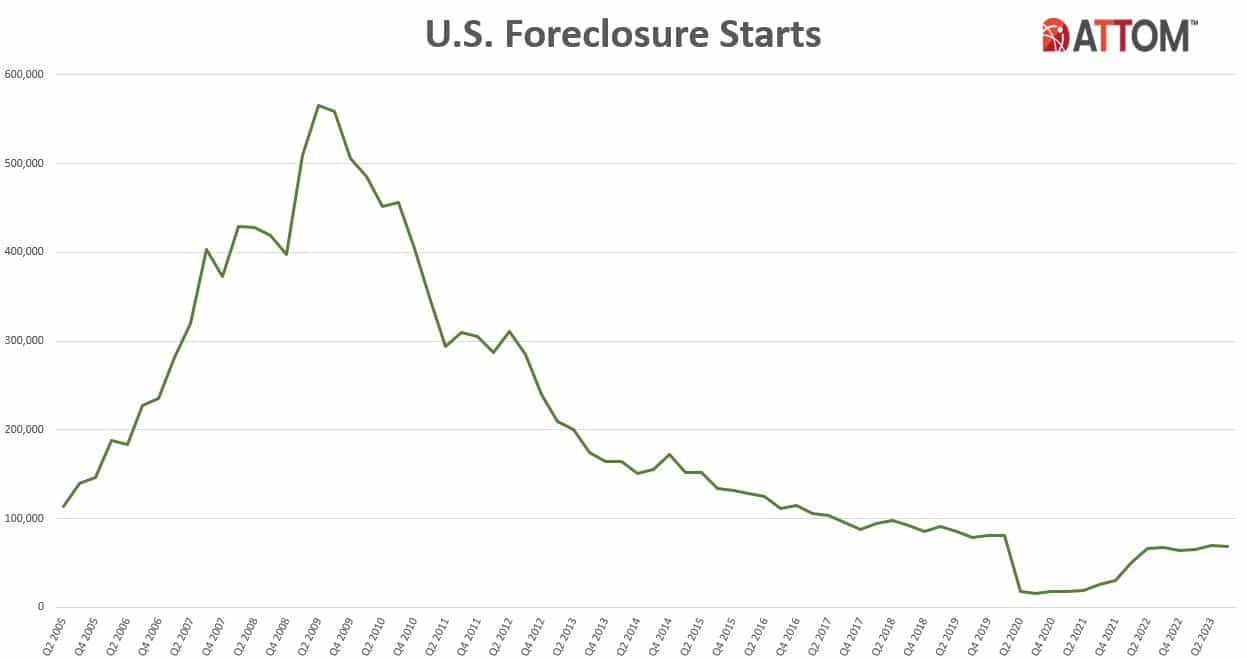

Economy rebounds, but foreclosure filings tell a different story. Amid a turbulent economic landscape, the US has witnessed a significant uptick in foreclosure filings in the third quarter. A new ATTOM report paints a concerning picture, with foreclosure filings reaching 124,539, which marks a 28% surge from the last quarter and a significant 34% rise year-over-year. Delving deeper into the monthly data, September alone saw an 11% increase in foreclosure filings, up to 37,679 properties. “The number of new cases filed by lenders in the third quarter did rise just a small amount from the same period last year and actually dipped a bit quarterly – signs that the upward pattern may be easing,” ATTOM’s CEO Rob Barber said. “But foreclosure starts are nearly back to where they were two years ago when the federal government lifted a pandemic-related moratorium on most foreclosure filings.” Barber also attributed the higher foreclosure rate to pending filings finally processing. “Even with the national economic upturn and job stability, it’s evident that some homeowners are still grappling with the pandemic’s financial aftermath or encountering new challenges,” he said. Several states experienced spikes in foreclosure starts for Q3 2023. North Carolina led the pack with a 53% increase, followed closely by Louisiana at 47%. Pennsylvania, Alabama, and Nevada also reported substantial annual hikes of 24%, 18%, and 16%, respectively.

On the metropolitan front, New York City reported the highest number of foreclosure starts in Q3 2023, with 4,514, followed by Chicago (2,584), Houston (2,279), Los Angeles (2,273), and Philadelphia (2,104). However, not all cities followed the national trend. Some metropolitan areas with populations exceeding one million reported declines in foreclosure starts for the same quarter. Salt Lake City led this group with a 74% decrease, while Chicago, Kansas City, Columbus, and Milwaukee also noted reductions of 35%, 34%, 22%, and 21%, respectively. Billions at stake as NAR faces legal challenges amid calls for reform.

The US residential housing market is under the microscope, with the broker commission system facing antitrust scrutiny from the Justice Department and two private class-action lawsuits. At the core of the investigation is the commission-sharing system, a structure that typically requires home sellers to pay a 5% to 6% cut of the sale, divided between their agent and the buyer’s agent. Bloomberg reported that a nationwide case to dismantle the commission-sharing structure is not only a potential threat to the National Association of Realtors (NAR), the industry’s lobbying group, but could also lead to drastic change in the real estate landscape. The commission-sharing system, largely unique to the US, is preserved by NAR’s control over many of the country’s multiple listing services. Critics argue that this structure inflates home prices, and Michael Ketchmark, lead plaintiffs’ attorney in the Missouri case, asserts that the structure equates to “collusion.” Legal challenges and damages. The legal challenges are substantial. The Missouri case alone could result in up to $4 billion in damages. The Illinois trial, scheduled for early next year, has plaintiffs seeking as much as $40 billion. “Our guess is that the lawsuits in Missouri and Illinois will not go that far, but it’s possible,” said Redfin CEO Glenn Kelman. He believes that a DOJ action is necessary to reach a level where the commission-sharing structure is dismantled, a move he suggests would leave “half the real estate agents in this country unemployed.” Redfin parted ways with the NAR earlier this month, attributing the split to its longstanding issues with agent compensation structure. DOJ’s concern over housing affordability and commission rates For the mortgage sector, the spotlight on commission rates comes at a time when the housing market is already grappling with low supply and escalating mortgage costs. The Biden administration’s focus on these rates is intertwined with the broader issue of housing affordability. On a median existing-home sales price of $407,100, a 5.5% commission amounts to approximately $22,390 – a cost often embedded in the home’s listing price and subsequently impacting the mortgage value. The Justice Department stressed the issue in a recent court filing, expressing its apprehension about “policies, practices, and rules in the residential real estate industry that may increase broker commissions,” the agency said. A shift in this area could reduce overall commissions by as much as $30 billion annually, according to a study by the Consumer Federation of America. NAR’s defense NAR, however, defends the existing system, asserting its role in facilitating homeownership for first-time buyers, especially those from minority and lower-income groups. “This case is very much about buyer representation and that being at risk,” NAR spokesperson Mantill Williams said in a statement. He emphasizes the importance of professional guidance in the home-buying process. NAR has pointed out that the commission for buyers doesn’t necessarily need to stick to the conventional 2.5%. NAR said it could be as low as $0. However, many sellers continue to opt for the higher rate, worried that if they offer less, buyers’ agents might direct clients elsewhere – a concern supported by recent studies. The evolving landscape threatens the future stability of NAR. The association collects $150 in annual dues from its vast membership of over 1.5 million agents. The organization, which last year outspent even the US Chamber of Congress with a whopping $80 million on lobbying, now faces an “existential threat,” David Greer, who has spent over a decade working with NAR, said. 30-year fixed mortgage rate hits staggering 7.7%, dampening homebuying activities.

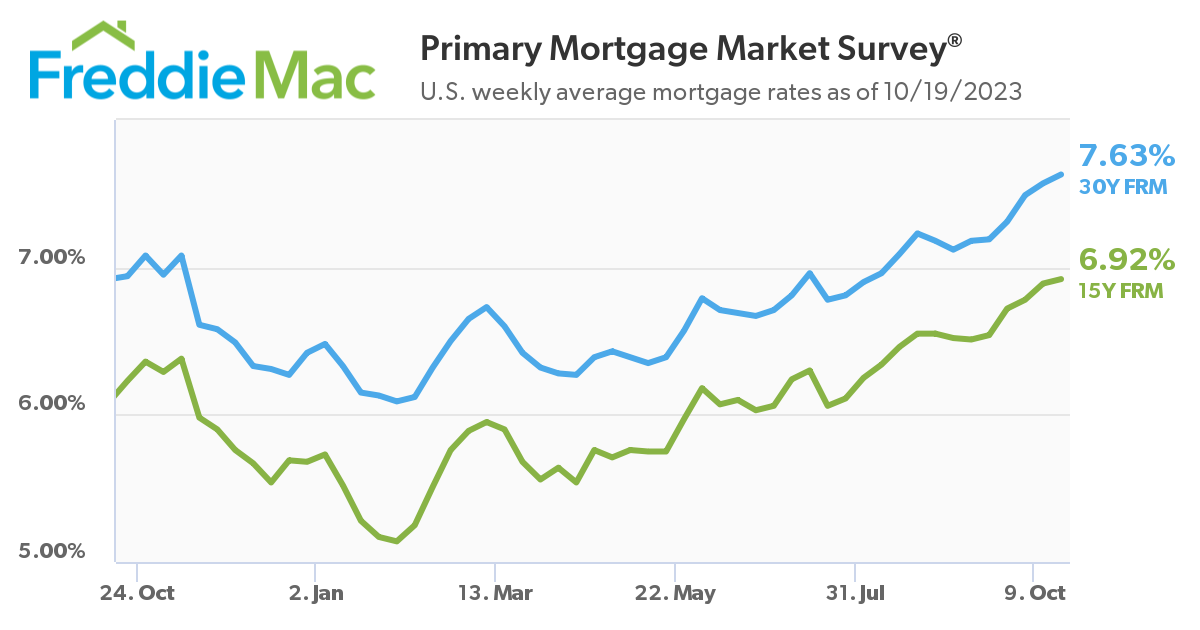

Mortgage applications plummeted to their lowest level in 28 years after weeks of consecutive increases in mortgage rates. The Mortgage Bankers Association (MBA) reported today that its Market Composite Index – a measure of loan application volume – fell 6.9% in the week ending October 13, marking the lowest level since 1995. This decline is attributed to the surge in the 30-year fixed mortgage rate, which has been on an upward trajectory for six consecutive weeks, reaching 7.7% – a peak not seen since November 2000. MBA's data also revealed a 10% decrease in the refinance index from the previous week and a 12% decline compared to last year. The seasonally adjusted purchase index fell by 6%, while the unadjusted version saw a 5% reduction, representing a 21% year-over-year decline. MBA deputy chief economist Joel Kan highlighted the impact of increased rates on potential homebuyers. "Purchase applications were 21% lower than the same week last year, as homebuying activity continues to pull back given reduced purchasing power from higher rates and the ongoing lack of available inventory," Kan said. Amidst these challenges, some borrowers are exploring alternative solutions to mitigate their monthly expenses, leading to the ARM share rising to 9.3%, the highest in nearly a year. The refinance share of mortgage activity also took a hit, dropping to 30.5% from 31.6% in the previous week. In contrast, the FHA share of total applications slightly increased to 14.8% from 14.4%, and the VA share rose to 10.7% from 10.2%. The USDA share remained stable at 0.5%. "Refinance activity was at its lowest level since early 2023," Kan said. "There is very limited refinance incentive with mortgage rates at multi-decade highs." The 30-year fixed-rate mortgage is on the brink of 8%. Even though the Fed paused any rate hike at its last meeting, long-term mortgage rates still continued to approach 8%, according to Freddie Mac. As of October 19, the average 30-year fixed-rate mortgage rose six basis points to 7.63%, while the 15-year loan saw a three-basis-point increase to 6.92%. Freddie Mac chief economist Sam Khater noted the broader implications of the rising rates, saying, "Not only are homebuyers feeling the impact of rising rates, but home builders are as well. Incoming data shows that the construction of new homes rebounded in September, but as rates keep rising, home builders appear to be losing confidence. As a result, we expect construction to trend down in the short-term."

Marty Green, principal at Polunsky Beitel Green, weighed in on the Federal Reserve's stance on rate hikes: "Powell's remarks confirm what Patrick Harker, President of the Philadelphia Fed and a member of the Open Market Committee, told the Mortgage Bankers Association earlier this week, that the Fed is likely done with rate hikes in this cycle. [Still] mortgage rates increased, making further adjustments by the Fed less necessary." "Higher-for-longer" is the current expectation, meaning that we expect rates to hover around 8% for the foreseeable future, likely well into 2024," said Erin Sykes, chief economist and broker at Nest Seekers International. "I believe that moving against the tide is the best way to get a deal. Inventory has been sitting, and prices are negotiable, even if they are not posted as such online. "Generally speaking, we are not hearing pushback regarding loan rates or pricing but more so concern about uncertainty and geo-political issues. People are hesitant to spend money unless they feel very confident that it will have long-term benefits. With current 30-year rates near 8%, and the potential of going higher in the short to mid-term, there is a good chance that today's purchasers would be able to refinance at lower rates in the coming years." The bank agrees to a $9 million, five-year settlement.

Washington Trust has agreed to a settlement with the Department of Justice alleged redlining or discriminating practices against communities of color by not providing them with services, as reported in an article by The Providence Journal. In a complaint filed to the federal District Court, the Rhode Island US Attorney’s Office said that the bank did not provide Black and Hispanic residents with their services in Rhode Island between 2016 and 2021. Allegations of discrimination The complaint outlined that Washington Trust had set the entire state of Rhode Island as its target area and began an expansion by opening of more branches. US Attorney Zachary Cunha argued that when the bank established this goal, its market should have included the majority Black and Hispanic neighborhoods in the state. However, Clarke said that the bank never opened branches within majority Black or Hispanic communities. The complaint also said that there were nearly no mortgage officers working at the bank that spoke in Spanish and its website was also largely not translated in Spanish. In 2011, Washington Trust was reported to have known about such discrimination issues from its internal compliance team as well as outside consultants that it had hired to conduct risk assessments. “Washington Trust took no meaningful action in response to these reports indicating that it was underserving Black and Hispanic borrowers and majority-Black and Hispanic neighborhoods, despite having knowledge of its underperformance and its redlining risk,” the complaint read. Washington Trust stated in an unsigned written statement that it denied the allegations and only agreed to the settlement in order to avoid the expenses and the distraction that came with the potential of litigation. Ned Handy III, the bank’s CEO, wrote that Washington Trust had been compliant with federal fair lending laws and it had several people at the bank that can speak languages besides English. The $9 million settlement money will be broken into three categories:

The tentative agreement has yet to be approved by a federal judge in order for the settlement money to be allocated in affected areas. |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media