|

Newly released survey data from rental search platform ApartmentList shows a shocking 28% of renters started 2021 with unpaid rent bills from previous months. This “rent debt,” according to the survey, is especially concentrated among younger renters and people of color. While rent debt improved marginally from October of 2020, recent downturns in employment might point to a worsening situation for renters and a lack of cashflow for landlords.

While such a high percentage of people owing back rent does pose some risk to the multifamily space, Chris Salviati, housing economist at Apartment List, believes that the damage might not be as bad as it appears on the surface. He cited the dramatic lengths renters have gone to in order to stay as current as possible and noted that some of Biden’s promised stimulus package could help erase some of these debts. He explained that for mortgage professionals working in the space, this rent debt represents an opportunity to find accommodative solutions that work for landlords and tenants in the long-term. “When we look at the amount of rent that folks owe it isn’t necessarily huge sums,” Salviati said. “The overall figure there was that 28% of respondents to our survey said that they were behind on their rent, but more than half of those said that they owe $1,000 or less, and it was only 2.4% of the of the overall sample that said that they owed $5,000 or more. And so, it does seem that most people are trying to keep up with their rent. “It doesn’t seem to be the case that because these moratoriums are in place, folks are just kind of sitting around skipping their rent checks altogether. I think there is an awareness that that these eviction moratoriums aren’t the same thing as rent forgiveness, and that once they expire whatever rent you accumulated, is still going to be owed to your landlord, and you will still be subject to eviction at that point.” Stimulus could be a particularly effective tool in addressing this “rent debt,” Salviati explained, as data from ApartmentList shows that in prior rounds of stimulus, people used the windfall to get or stay current on their rent. The likelihood of significant stimulus, as well as some of the dramatic steps people have already taken to stay current on rent, is part of why Salviati believes this won’t structurally damage the multifamily space. The concentration of rent debt in communities of color and younger people, however, points to some deeper structural issues in the US economy, according to Salviati. He noted that this is one of the many economic fault lines that have been exposed and exacerbated by the pandemic, as most of the people owing rent debt work jobs that can’t be done remotely and have been much more likely to lose income due to lockdowns and suppressions in economic activity. In Salviati’s opinion, mortgage professionals shouldn’t greet this news as a sign of structural damage done by eviction moratoriums. With the economy and rental market being what it is at the moment, Salviati noted that an eviction might not actually solve the problem. He believes that mortgage pros should look at this as an opportunity to help both tenants and landlords get back on their feet by providing financing solutions and accommodative agreements that will help every stakeholder get through this particularly rough patch for so many Americans. “A lot of folks in our survey are telling us that they are really doing everything they can to be able to pay their rent. They’re making pretty extreme financial sacrifices,” Salviati said. “From an industry perspective it’s important to keep that in mind and to be able to work with tenants and landlords to try to come to an arrangement.”

0 Comments

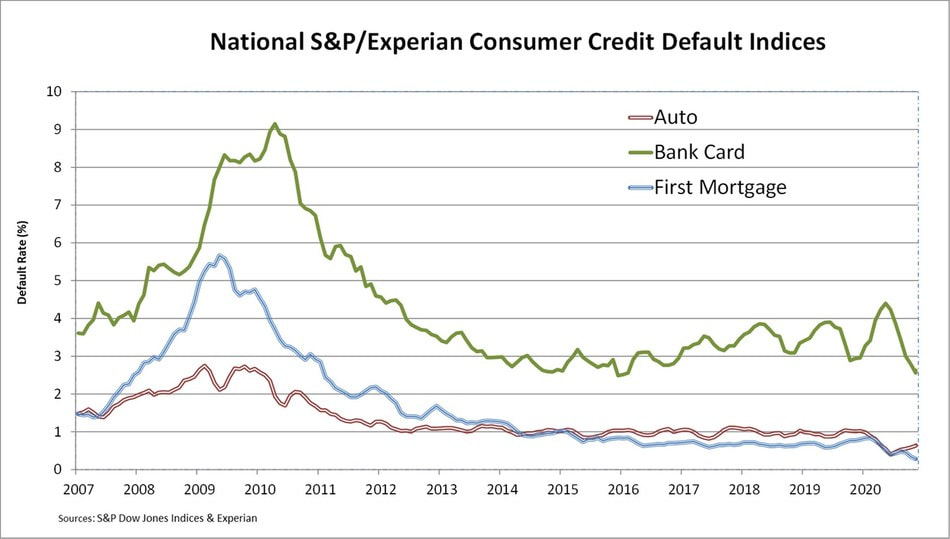

The default rate of first and second lien mortgages edged up in December, according to data from S&P Dow Jones Indices and Experian.

The latest S&P/Experian Consumer Credit Default Indices show that the first mortgage default rate was up slightly from 0.28% to 0.29% in December. The bank card default rate also saw a month-over-month increase of seven basis points to 2.63%. Meanwhile, the composite rate held steady at 0.46%, and the auto loan rate remained unchanged at 0.64%. Of the five major metropolitan statistical areas (MSAs), two posted lower default rates in December. Los Angeles and Chicago each dropped two basis points to 0.35% and 0.52% respectively. Dallas and Miami were both unchanged, at 0.56% and 0.86% respectively. New York was the only outlier, with its default rates up one basis point to 0.42%. The indices are designed to track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien. The Indices are calculated based on data extracted from Experian’s consumer credit database, which includes several bank and mortgage company contributors, and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders. The Federal Housing Finance Agency (FHFA) has announced a further extension on foreclosure moratoriums on government-backed mortgages and eviction bans on real estate owned (REO) properties.

In a Press release, the FHFA said that Fannie Mae and Freddie Mac will extend their moratoriums on single-family foreclosures and REO eviction until February 28. The foreclosure moratorium applies to government-backed, single-family mortgages. Meanwhile, the REO eviction ban applies to properties that have been acquired by Fannie or Freddie through foreclosure or deed-in-lieu of foreclosure transactions. “To keep our communities safe, and families in their homes during the COVID-19 pandemic, FHFA is extending Fannie Mae and Freddie Mac's foreclosure and eviction moratorium,” said FHFA Director Mark Calabria. This is the fifth time the agency has extended the bans. Last week, president-elect Joe Biden proposed pushing back the moratoriums for another eight months. But some housing providers said that Biden's plan would only create a larger mess for landlords and tenants. “In the end, there will be an even bigger tsunami of evictions and foreclosures,” said Richard Kruse, principal of asset management firm Gryphon USA. ”This is a delay in the market unraveling itself and increases the inevitable consequences.” The agency projects that the GSEs would shoulder additional expenses of $1.4 billion to $2 billion due to the existing COVID-19 foreclosure moratorium and its extension. We’re not breaking any news when we say that January 01 of 2021 didn’t bring an immediate end to the uncertainty, challenges, and global pandemic that defined much of 2020. The beginning of vaccine rollouts and a change in both the presidential administration and partisan control of the Senate do mean that 2021 is set to be a year of significant change, however. But what will those changes mean for a struggling US economy and a booming US housing market? How can mortgage professionals best position themselves to win in another year of flux?

Fannie Mae chief economist Douglas Duncan (pictured) believes that the US economic recovery is still marching to a tempo set by the pandemic. While he expects an economic recovery to take hold by the second half of this year, that prediction rests largely on the assumption of a successful vaccine rollout. Stimulus, too, will play a crucial role in that recovery and while aggregate losses ought to be made up by this year’s end, Duncan noted that the damage done to certain sectors might make the recovery somewhat uneven. With the recovery underway, facilitated by a low-rate environment, Duncan expects a strong year for the mortgage business, but one that might not break the records set in 2020. “The housing market we think is going to slow a little bit,” Duncan said. “That doesn’t mean it’s declining, it just means the pace of appreciation will be slower. We still expect a very strong year, probably stronger than 2019. It’s just that 2020 was completely historic. Last year’s house prices appreciation was at about 10%, which is simply not sustainable, from an affordability perspective. We think house price [appreciation] will come down to about half of what it was over the year as builders catch up and people who could offer their homes for sale but were fearful of the virus start to list their homes.” Growth in a post-pandemic economyOverall, Duncan and his team are estimating the economy shrank by 2.7% in 2020 and will end 2021 at a 5% growth rate. Key to that rebound will be both the rollout of the vaccine and a wider psychological shift among Americans, that they feel safer resuming life as normal once again. Once the psychological and epidemiological burden of the virus is lifted, Duncan expects the economy, and potentially the housing market, can enjoy an additional lift when Americans start spending some of the money they’ve saved in the past year. He estimates that savings rates among Americans are roughly 50% higher than they would normally be, meaning there’s a lot of capital on consumer balance sheets ready to be deployed. In addition to that private cash injection, Duncan noted the ongoing dovish stance the Fed is planning to take and the likelihood of Biden’s historic $1.9 trillion stimulus package as likely to jumpstart economic growth in the year to come. While much of that spending and cash might prompt inflationary fears, Duncan said we might not see widespread inflation until 2022. A slower, but still strong, housing marketIn predicting a slower housing market and a correction in house prices this year, Duncan emphasized the truly unique conditions of 2020. The initial lockdowns of spring, he explained, upended the seasonality of the purchase market and pent up demand that would be released later in the year. He also expects rates to trickle upwards from their 2020 lows and, as we learned in 2013 and 2018, market-driven upticks of around 100 basis points can lead to 10% drops in home sales. Duncan is still expecting positivity in the housing market, however, driven by a millennial generation that is entering peak homebuying age. That generation, too, skews towards the kind of salaried employment that usually results in homeownership. Duncan expects housing demand to soften due to rate increases and the rising potential of inflation. At the same time, he predicts a strengthening in supply thanks to high rates of new home construction and the listing of new homes on the market by owners previously too afraid of the virus to move. Where to lookIn making these predictions, Duncan is focusing on a few key indicators that may point to whether or not his forecasts prove accurate. On the policy side he’s looking to see whether policies are temporary or more permanent. Duncan cited past tax cuts during the Bush and Obama administrations that resulted in temporary changes in behaviour without altering market fundamentals. On the market side, he’s watching for inflation. While expectations of inflation have risen, question marks persist around whether they will be sustained. If they are sustained, we will see just how far and for how long the Fed is willing to let inflation run. Looking directly at the housing market, Duncan is asking whether the shift in demand to low-density housing outside of urban centers is going to be a permanent change. That will be shaped by the re-emergence of major cities as attractive places to live again and by how so many people will eventually return to work. “One of the questions about large suburban homes was when the boomers decided to downsize will there be anybody who wants to buy them given the family sizes among younger age groups have been falling,” Duncan said. “Well today, if a family has two incomes, even if they only have one child, they might still require four bedrooms, one for the parents, one for the child and two offices. That could be a cultural shift and a technological shift that leads to housing impact. We’ll be watching to see whether there is permanence to that.” President Joe Biden plans to extend bans on home evictions and foreclosures imposed last year to mitigate the dual economic and health crises spurred by the COVID-19 pandemic.

As part of a package of executive orders Biden plans to sign within hours of his Wednesday inauguration, he will ask the Centers for Disease Control and Prevention to delay expiration of an order barring landlords from pushing out some tenants for non-payment of rent. The order calls for the moratorium, set to expire at the end of this month, to be extended through at least March 31. In addition, Biden plans to ask the departments of Veterans Affairs, Agriculture and Housing and Urban Development to consider extending foreclosure restrictions and forbearance relief. Biden’s economic team had previously signaled they would seek an extension of the CDC moratorium, adding that it would give tenants certainty that they won’t be cast out of their homes in the face of a public health emergency that has seen millions of Americans lose their jobs and fall deeper into debt. Officials have also warned that ejecting swaths of renters during the US winter as COVID-19 rages would exacerbate the virus’s spread. The US economy, which was largely shut down as the pandemic peaked, has seen an uneven recovery that has largely spared white-collar workers while severely hitting people in lower-paying jobs. The poverty rate hit 11.7% in November, with 7.8 million Americans added the to the ranks of the poor since midyear, according to a monthly COVID poverty tracker devised by three economists. Landlords’ deficit Landlords are owed more than $70 billion in back rent, utilities and additional fees, according to an estimate by Mark Zandi, chief economist at Moody’s Analytics. The CDC order was part of an overlapping series of responses to the pandemic’s economic impact from US agencies including HUD and the Federal Housing Finance Agency. The FHFA, the independent agency that oversees Fannie Mae and Freddie Mac, said in December that some landlords with loans financed by the two mortgage giants can pause payments through March so long as they don’t evict tenants for non-payment of rent. On Tuesday, the FHFA said Fannie and Freddie would pause foreclosures and evictions on homeowners through February. HUD, which guarantees mortgages for lower-wealth borrowers, in December extended its own foreclosure and eviction moratorium through February. Spending on construction projects has continued to climb in the US as the COVID-driven housing boom continues into 2021.

A report from the US Commerce Department released Monday showed strong demand and ultra-low mortgage rates pushed US construction spending up by 0.9% to an annual rate of $1.459 trillion in November. The increase followed a 1.6% gain in October, up to a revised rate of $1.447 trillion. Economists polled by Reuters forecast construction spending to climb by 1% compared to the 1.3% rise reported for October. “Strong residential activity has driven construction past pre-pandemic levels, but non-residential outlays remain nearly 6% below their early 2020 pace,” Nancy Vanden Houten, lead US economist at Oxford Economics, told RTTNews. “We expect this divergence in construction spending to narrow a bit as we move through 2020 as some recovery in non-residential outlays is expected to take hold, particularly in private spending.” Spending on residential construction jumped 2.7% to a rate of $658.1 billion, with single-family construction up by 5.1%. This was more than enough to offset the 0.8% decline in spending on non-residential construction projects like gas and oil well drilling, which were down to a rate of $453.8 billion, according to the report. Spending on public construction spending also dropped in November, edging down by 0.2%. “Public outlays will likely continue to be constrained by tight state and local budgets despite a better than expected performance for revenues during the pandemic,” said Vanden Houten. Record-low mortgage rates were supposed to make it easier for homebuyers. Instead, they’ve helped push affordability to a 12-year low.

Buyers in the fourth quarter needed to spend almost 30% of the average wage to afford a typical house, the biggest share for any three-month period since 2008, according to preliminary figures from Attom Data Solutions. Low borrowing costs, now below 3% for a 30-year loan, have spurred a buying frenzy, driving up prices across the country as shoppers compete for a shrinking supply of listings. During the pandemic, prices have increased faster than earnings, leaping by double digits in 79% of the 499 counties included in the report. More than half of those counties are now less affordable than their historic averages, Attom said in a report Thursday. Mortgage rates ended 2020 near the lowest on record, with the average for a 30-year loan at 2.67%, Freddie Mac said Thursday. “The future remains wholly uncertain and affordability could swing back into positive territory,” said Todd Teta, chief product officer at Attom. “But, for now, things are going in the wrong direction for buyers.” A gauge of US pending home sales fell for the third consecutive month in November, suggesting higher prices and limited inventory are slowing momentum in the housing market despite record-low borrowing costs.

The National Association of Realtors’ index of contract signings to purchase previously owned homes declined 2.6% from the prior month to 125.7, according to data released Tuesday. The median estimate in a Bloomberg survey of economists called for no change in November. Compared with a year earlier, pending sales were up 16% on an unadjusted basis. The drop in the index from the prior month shows more tempered activity in the housing market as prices continue to climb amid lean inventory. Still, the pending sales gauge remains well above pre-pandemic levels, indicating still-elevated demand as buyers seek more space. “The latest monthly decline is largely due to the shortage of inventory and fast-rising home prices,” Lawrence Yun, NAR’s chief economist, said in a statement. “The market is incredibly swift this winter with the listed homes going under contract on average at less than a month due to a backlog of buyers wanting to take advantage of record-low mortgage rates.” A separate report last week showed existing home sales, calculated when a contract is closed, fell in November for the first time in six months, underscoring the challenges for housing market growth as surging prices threaten affordability. Pending home sales declined in all four major US regions. The gauge of contract signings in the West dropped 4.7% to a four-month low. In the Midwest, pending sales declined 3.1%, while in the South they fell 1.1%. |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media