|

But two months of increasing prices do not make a definite recovery, CoreLogic says.

House price appreciation accelerated on a monthly basis in March, according to the latest CoreLogic S&P Case-Schiller Index. Month over month, the national home price index gained 1.3% on a seasonally unadjusted basis, while the 10-City and 20-City Composites saw increases of 1.6% and 1.5%. After seasonal adjustment, home prices were up 0.4%, while the 10-City Composite increased 0.6% and 20-City Composite climbed 0.5%. “The modest increases in home prices we saw a month ago accelerated in March 2023,” explained Craig Lazzara, managing director at S&P DJI. “The National Composite rose 1.3% in March and now stands only 3.6% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with March gains of 1.6% and 1.5%, respectively.” The year-over-year house price index also rose modestly, up 0.7% in March. The acceleration was apparent in many Western states. “The CoreLogic S&P Case-Shiller Index squeezed a 0.7% year-over-year increase in March. But, monthly gains, up 1.3% from February, are almost double the increase seen between the two months and suggest housing market competition heated up again in early spring, particularly in West Coast markets where most of the housing slowdown occurred in the second half of 2022,” said CoreLogic chief economist Selma Hepp. “Strongest monthly gains were in San Francisco and San Diego. In addition, higher-priced homes are once again leading the monthly gains in prices after months of relatively larger weakness following the housing slowdown.” “One of the most interesting aspects of our report continues to lie in its stark regional differences,” Lazzara added. “Miami’s 7.7% year-over-year gain made it the best-performing city for the eighth consecutive month. Tampa (+4.8%) continued in second place, narrowly ahead of bronze medalist Charlotte (+4.7%). The farther West we look, the weaker prices are, with Seattle (-12.4%) now leading San Francisco (-11.2%) at the bottom of the league table. It’s unsurprising that the Southeast (+5.4%) remains the country’s strongest region, while the West (-6.2%) remains the weakest.” However, Lazzara stressed that while two months of increasing prices do not make a definite recovery, March’s results suggest that the decline in home prices that began in June 2022 may have come to an end. “The challenges posed by current mortgage rates and the continuing possibility of economic weakness are likely to remain a headwind for housing prices for at least the next several months,” he said.

0 Comments

Demand drops as mortgage rates hit highest level in six months.

Application volume for mortgage loans declined for the third consecutive week against an increasingly cloudy economic backdrop, the Mortgage Bankers Association reported today. MBA’s Market Composite Index, a measure of mortgage applications, slumped 3.7% on a seasonally adjusted basis for the week ending May 26. The index was down 5% week over week on an unadjusted basis. “Inflation is still running too high, and recent economic data is beginning to convince investors that the Federal Reserve will not be cutting rates anytime soon,” said Mike Fratantoni, MBA’s chief economist. “Mortgage rates for conforming balance 30-year loans were being quoted above 7% by some lenders last week, and the weekly average at 6.9% reached the highest level since last November.” Higher rates have pushed refinance application activity down 7% from the previous week, and purchase application volume dropped 3%. The refinance share of total applications increased by two basis points to 12.7% from the week earlier. “Application volumes for both purchase and refinance loans decreased last week due to these higher rates,” Fratantoni said. “While refinance demand is almost entirely driven by the level of rates, purchase volume continues to be constrained by the lack of homes on the market.” Buyers' activities based on fear could produce a crisis.

Given the mercurial and unpredictable market, it’s almost become fashionable for people to predict a housing crash. Those taking a contrarian view have been all but ridiculed – particularly among those not understanding the intricacies of the market. Rebecca Richardson, of UMortgage, is among those who predicted early that a housing crash would not emerge – making the positive prognostication one year ago. “Certainly got some strong opinions on why I was wrong,” she says now with a measure of sarcasm targeting her naysayers. A year after going out on a limb dismissing gloomy housing crash prognostications, she points to growing evidence suggesting the scenario isn’t likely to emerge – despite challenging market forces. “Recession, inflation, stagflation -- all of it matters, all of it can have a big impact on American households,” she said. “But that doesn’t mean the housing market’s going to crash.” Take the National Home Price Index, for example: She pointed to the National Home Price Index as evidence of why a housing market crash is unlikely. Compiled and published monthly, the index measures the change in the value of the US residential housing market by tracking the purchase prices of single-family homes. The index tracks housing prices historically, making allowances for past recessionary periods. “During those recessions – except really around 2008 – for the most part home values continued to increase,” she noted. The housing market bubble burst in 2008 when subprime mortgages, a massive consumer debt load and crashing home values converged, as recorded in Investopedia. An untold number of homeowners found their homes figuratively underwater – homeowners owing more than their houses were worth – as they defaulted on their mortgages. “I’m not saying that we won’t see some sort of correction or that some cities, some areas, won’t see declines because some of them have run incredibly too hot,” she said. “However, that does not mean that we’re necessarily headed for a housing crash.” For the most part, economists share Richardson’s view. Housing economists point to five main reasons why the market isn’t likely to crash anytime soon: a drop in foreclosures; lack of newly constructed housing supply; low inventory; plenty of new buyers; and stricter lending standards. Apparently, there’s not even so much as a bubble in today’s market. Len Kiefer, deputy chief economist at Freddie Mac, recently explained to Forbes why the US housing market is not currently encased in such a bubble. “A bubble has three defining characteristics: price growth is driven by speculation, bubbles are fueled by credit expansion, bubbles pop,” Kiefer told the magazine. “While house prices grew at record rates in 2021, the reasons for the increase were not primarily speculation or credit expansion, but rather record-low mortgage rates and a fundamental shift in housing demand.” Yet some economists believe a bubble could emerge – not contingent on market forces but in disenfranchisement from economic reality based on buyers’ psychology. Shifts in disposable income, cost of credit and access to it, supply disruptions and rising labor and raw construction materials costs are among the economic reasons for sustained real house-price gains, the Federal Reserve Bank of Dallas explained in a report published last year. Borrowers should not act on fear“: But real house prices can diverge from market fundamentals when there is widespread belief that today’s robust price increases will continue,” the bank’s economists cautioned. “If many buyers share this belief, purchases arising from a ‘fear of missing out’ can drive up prices and heighten expectations of strong house-price gains.” The Federal Reserve Bank of Dallas warns that this “self-fulfilling mechanism leads to price growth that may become exponential (or explosive), resulting in the housing market becoming progressively misaligned from fundamentals until investors become cautious, policymakers intervene, the flow of money into housing dries up and a housing correction or even a bust occurs.” This is what’s called “expectations-driven explosive appreciation” or simply “exuberance” in real house prices that can have many consequences, economists warn, including “…the misallocation of economic resources, distorted investment patterns, individual bankruptcies and broad macroeconomic effects on growth and employment.” Monitoring the housing market in real time for the emergence of such price booms can help investors and policymakers respond before such misalignments become so severe that subsequent corrections create economic upheaval, economists explain. Bottom line: Don’t invest based on fear. Richardson agrees: “If buying a home made sense to you a year or two years ago, it probably still makes sense,” she says. “But you need to make sure you’re working with a lender and a realtor who can advise you on your options, on the market, so you can make a smart, informed decision instead of one out of fear.” Volatility in mortgage rates continues to impact application volume.

Mortgage applications declined again for the week ending May 19, a sign that borrowers remain sensitive to the fluctuation in interest rates. Total application volume fell 4.6% on a seasonally adjusted basis and 5% on an unadjusted basis, the Mortgage Bankers Association reported today. The decline comes as the average contract interest rate for the 30-year fixed mortgage rate reached a new record high. “Mortgage applications declined almost 5% last week as borrowers remained sensitive to higher rates,” said Joel Kan, MBA’s vice president and deputy chief economist. “The 30-year fixed rate increased to 6.69%, the highest level since March.” Both refinance, and purchase applications decreased 5% week over week. The refinance share of mortgage activity stayed unchanged at 27.4% of total applications. “Since rates have been so volatile and for-sale inventory still scarce, we have yet to see sustained growth in purchase applications,” Kan said. “Refinance activity remains limited, with the refinance index falling to its lowest level in two months and more than 40% below last year’s pace. “Investors remained attuned to the uncertainty around the US debt ceiling and communication from several Federal Reserve officials last week, which sent Treasury yields higher, along with mortgage rates. Economic data released over the past week have also pointed to a still-resilient economy. The housing market received positive data on new residential construction – which is seen as a key solution to the lack of housing inventory.” Elevated interest rates and low housing supply are to blame. Homebuyers applying for a mortgage saw increases in their monthly payment and median purchase amount due to high-interest rates and home prices, the Mortgage Bankers Association reported Thursday. Homebuyer affordability issues continued in April, with data from MBA’s new survey showing that the national median payment applied for by purchase applicants rose 0.9% to $2,112 from $2,093 in March. The median mortgage payment for purchase mortgages decreased to $2,445 in April from $2,508 in the prior month. MBA’s Purchase Applications Payment Index (PAPI) climbed 0.5% month over month to a new record high of 172.3 in April. Compared to a year ago, the index was up 5.3%. The uptick is a sign that the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. “Elevated interest rates and low housing supply have kept many prospective borrowers on the sidelines,” said Edward Seiler, associate vice president of housing economics at MBA and executive director of Research Institute for Housing America. “However, MBA expects mortgage rates to stabilize and inventory levels to improve, which should incentivize some buyers to re-enter the market.”

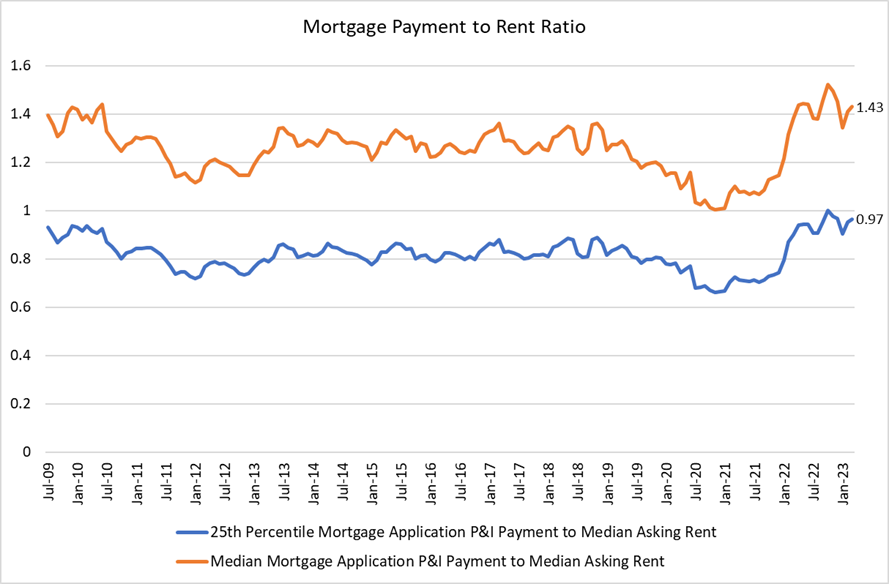

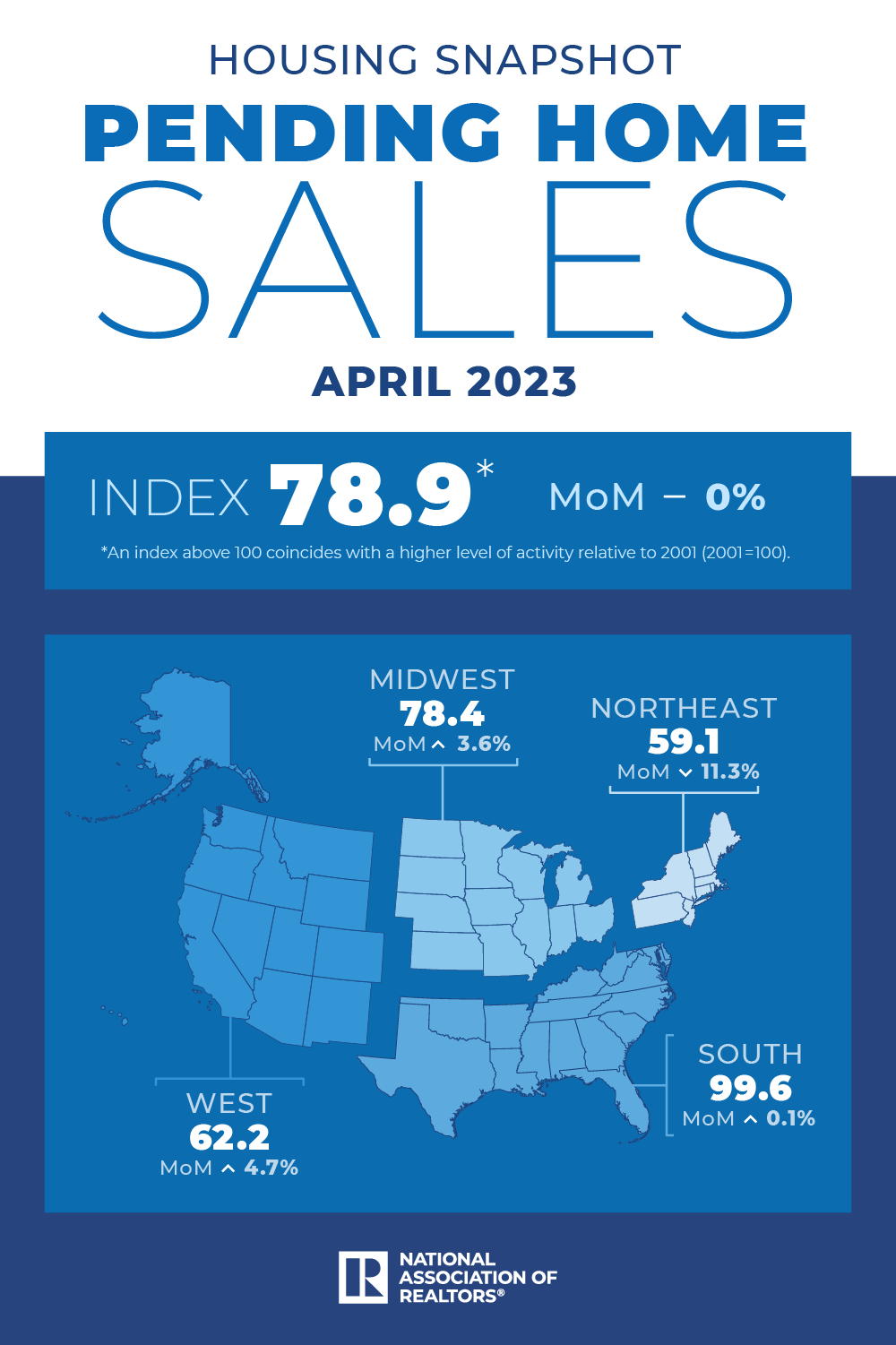

Meanwhile, the national mortgage-payment-to-rent ratio decreased to 1.43 at the end of the first quarter, from 1.45 in the previous quarter. This means mortgage payments for home purchases have decreased relative to rent. According to the Census Bureau, the median asking rent increased 10.5% quarter over quarter to $1,462. The 25th percentile mortgage application payment to median asking rent ratio plateaued at 0.96 in March. Housing shortage and affordability issues hold back pending home sales transactions. The Spring homebuying season is off to a sluggish start, as pending home sales remained flat in April. The National Association of Realtors recorded no change in its Pending Home Sales Index (PHSI), which hovered at 78.9 in April. However, pending home sales activity was down 20.3% from a year ago. “The housing market has struggled to gain momentum during the industry’s crucial spring homebuying season,” said First American deputy chief economist Odeta Kushi. “According to data from First America Data & Analytics, historically approximately 36% of existing-home sales for the year occur from March through June.”

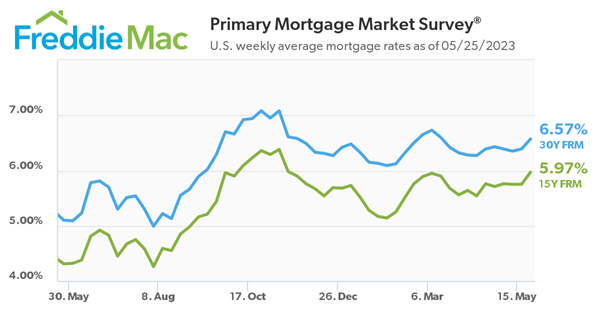

You can’t buy what’s not for sale Kate Wood, home expert at NerdWallet, stressed that affordability remains a hurdle for many homebuyers. “Given challenges to affordability from home prices and higher mortgage rates, as well as growing uncertainty about the US economy, it’s unsurprising that contract signings appear to be stalling,” Wood said. “It’s unclear at this point whether we’ll see a bump as data becomes available for the traditional spring homebuying months.” NAR chief economist Lawrence Yun added that not all contract signings are being completed due to limited inventory. “Affordability challenges certainly remain and continue to hold back contract signings, but a sizeable increase in housing inventory will be critical to get more Americans moving.” “Mortgage application trends tell a similar story,” Kushi pointed out. “Since most home purchases include a mortgage, the volume of mortgage applications should lead home sales. The Mortgage Bankers Association’s seasonally adjusted purchase mortgage applications series has remained mostly flat since February. May has also been a slow month. “There are plenty of interested prospective home buyers on the sidelines, but volatile mortgage rates, economic uncertainty, and limited inventory discourages prospective buyers and holds back sales activity.” Regional pending home sales activity All four regions saw annual declines in pending home sale transactions. The Northeast PHSI fell 11.3% month over month and 21.8% year over year to 59.1 in April. The Midwest index improved 3.6% to 78.4 in April, but down 21.4% from last year. The South posted a 0.1% month-over-month increase to 99.6 in April but sank 16.7% year over year. The West index registered a 4.7% rise to 62.2, sliding 26% from April 2022. “Minor monthly variations in regional activity are typical,” said Yun. “However, cumulative results over many years clearly point towards a much greater number of home sales in the South. The South’s pending home sales activity is similar to that of 2001, but the Midwest’s activity has decreased by 22% in that same period, and the Northeast and West regions are both about 40% lower than they were in 2001,” Yun added. Rates will retreat if the Fed provides investors with more certainty, says First American economist. Long-term mortgage rates rose this week as debt ceiling worries continued to weigh on the housing market. The 30-year fixed-rate mortgage jumped 18 basis points to 6.57% as of May 25, according to the results of Freddie Mac’s Primary Mortgage Market Survey. The rate for the fixed 15-year loan averaged 5.97%, up from 5.75% last week. “The US economy is showing continued resilience which, combined with debt ceiling concerns, led to higher mortgage rates this week,” Freddie Mac chief economist Sam Khater said. “Dampened affordability remains an issue for interested homebuyers, and homeowners seem unwilling to lose their low rate and put their home on the market.

If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage.” First American deputy chief economist Odeta Kushi analyzed the spread between mortgage rates and the 10-Year Treasury Yield and how it might shift in the months ahead. “Since the end of the Great Recession, the 30-year, fixed mortgage rate has on average remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield,” Kushi explained. “Yet, this spread is not always consistent. It usually widens during periods of economic or geopolitical uncertainty, as is the case in today’s market. Since the year 2000, there have been 59 months, approximately 21% of the time, when the average spread was at least 200 basis points.” Kushi noted that there’s a possibility that the spread could narrow but may not return to historical norms. “It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty,” she added. “However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.” "Lots more price declines are coming".

The prices of US commercial real estate properties fell for the first time since 2011, according to Moody’s Analytics. Moody’s reported a less than 1% drop in CRE prices in the first quarter, subsequent to the slowdown in the multifamily and office sectors. Experts view the price decline as a sign of heightening financial stress in the banking industry. According to the Federal Reserve, banks accounted for more than 60% of the $3.6 trillion commercial real estate loans outstanding in the fourth quarter of 2022. The Fed noted that “the magnitude of a correction in property values could be sizable and therefore could lead to credit losses” at banks. “Regional and community banks currently account for a disproportionately large share of office real estate lending,” said Bloomberg economist Stuart Paul. “Further consolidation of the banking industry may prove to be the solution that allows the banking industry at-large to work out problem loans.” “Lots more price declines are coming,” warned Mark Zandi, chief economist at Moody’s Analytics. The Mortgage Bankers Association forecasted that commercial and multifamily mortgage transactions will fall to $654 billion this year, a 20% plunge from $816 billion in the previous year. “We expect maturing loans to begin to break the logjam and provide greater clarity as this year goes on. However, it may take until 2025 for volumes to get back to previous years’ levels,” said Jamie Woodwell, head of commercial real estate research at MBA. Applications slow as interest rates increase.

Demand for mortgages fell 5.7% week over week as the average interest rate for 30-year mortgages surged to a two-month high, according to the Mortgage Bankers Association. MBA reported today that home loan application volume was down 5.7% on a seasonally adjusted basis for the week ending May 12. Unadjusted, applications declined 6% from one week earlier. “Mortgage rates increased last week even as Treasury yields were essentially flat, with the spread between the two rates widening to 310 basis points,” MBA deputy chief economist Joel Kan explained. “Mortgage application activity slowed, as most mortgage rates in the survey increased, with the 30-year fixed rate jumping nine basis points to its highest level in two months at 6.57%.” Both refinance and purchase application volumes also edged down from the week prior. MBA’s refinance index declined by 8%, and the purchase index decreased by 4.8%. “Purchase applications decreased 5% to its slowest pace in a month, as buyers remain wary of this rate volatility, but also as for-sale inventory in many parts of the country remains scarce,” added Kan. “Refinance applications accounted for 27% of all applications and dropped almost 8% last week. Most borrowers have lower rates on their mortgages, and those who are in the market are extremely rate sensitive.” Of total applications, the refinance share of mortgage activity dipped six basis points to 27.4%, and the adjustable-rate mortgage share of application volume slipped to 6.5%. Major buildings are gathering dust.

In the heart of Chicago’s financial center, a seven-story building occupying much of a city block was once home to the world’s largest options exchange. Now, it’s collecting dust. The property, for decades home to the floor where options traders jostled and screamed orders at each other, has been on the market since 2019, but owner Cboe Global Markets Inc. can’t find a buyer. The Chicago Board of Trade building, once a key commodities hub, has fared even worse, with lenders handing the keys over to Apollo Global Management Inc. Over on the Magnificent Mile, the famed shopping strip that runs north of the Chicago River on Michigan Avenue, empty storefronts dot the streets, with vacancies at a record. CME Group Inc. Chief Executive Officer Terry Duffy said in an interview that he’s prepared to leave Chicago if the city and state take steps that are perceived as “ill-conceived.” Hollowed-out downtowns are a depressing characteristic of American cities right now, whether it’s Market Street in San Francisco or Wall Street in New York. But Chicago, the third-largest city in the US, faces its own challenges that threaten its status as one of the main global financial hubs. Not only has the Midwest’s commercial center been struggling with the slow return of workers — the region’s office attendance is about half of pre-pandemic levels, according to security firm Kastle Systems — but the departure of major companies including Citadel and Boeing Co. stands to leave a tough-to-fill void. Guggenheim Partners, a large financial employer in the region, has kept its offices largely shut, while companies including Cboe and Allstate Corp. aren’t mandating that all workers return to the office. Against that backdrop, the city is grappling with a surge in crime, including carjackings and robberies, that cost Mayor Lori Lightfoot her job this year. Now it’s up to her replacement, Brandon Johnson, a progressive who is taking office Monday, to turn around the city’s flailing fortunes, including reversing the decline of downtown. Things aren’t looking up for the commercial real estate market, with the city’s office-vacancy rate reaching a record 22.4% in the first quarter. Even tech companies, once seen as a bright opportunity for Chicago’s future, are retrenching: Salesforce Inc. and Meta Platforms Inc. are giving up almost 240,000 square feet (22,300 square meters) of space. “Something dramatic needs to be done,” said Andy Gloor, chief executive officer of Sterling Bay, a major developer behind the trendy Fulton Market neighborhood. “Chicago is not going be able to thrive without a dynamic central business district.” One particular blow came from meatpacking giant Tyson Foods Inc., which has previously announced it would shut its local offices. It exited 234,000 square feet of downtown office space in the first quarter. Chicago fared the second-worst among 11 US cities in an index of office leasing activity, ahead of only San Francisco in the first quarter, according to real estate firm CBRE Group Inc. Tenants leaving their current space or downsizing due to hybrid work or recent layoffs added 1.5 million square feet of sublease space in downtown Chicago in the first three months of the year, CBRE data show. That’s enough space to house about 15,000 to 20,000 people. “A lot of these companies are trying to test-drive whether or not having smaller space, having a bit more flexible space and working remotely will allow for the same productivity,” said Matt Carolan, who co-leads a team of real estate brokers at Jones Lang LaSalle Inc. It’s a contrast to finance-heavy New York, where Mayor Eric Adams has been pushing companies to bring employees back to office towers and Wall Street executives have been critical of remote work. JPMorgan Chase & Co. told its managing directors last month that they must be in the office every weekday. Tom Wilson, CEO of Allstate, said the insurer has found that “flexibility really sells” and the post-pandemic policy has helped recruiting efforts in all locations across the country. “We decided to treat our employees as customers,” Wilson said. “We sell them a job, and a job comes with some money, some professional growth — and now it comes with more flexibility.” Behind the scenes, Chicago officials say employers have been extra flexible with workers for fear of losing people in a tight labor market. It’s a challenge for the city where business leaders have criticized rising crime, but empty streets aren’t conducive to safe environments either. Crime incidents in Chicago jumped 41% last year from 2021, and another 43% so far in 2023. Billionaire Ken Griffin cited violence as one of the reasons for moving his Citadel business to Miami, while CME’s Duffy recently opened up about his wife being carjacked in broad daylight. “We need to continue to create reasons for people to come downtown,” said Michael Fassnacht, head of World Business Chicago and the city’s chief marketing officer. “I encourage all the corporate leaders to have at least a three-days-in-the-office policy.” There are other knock-on effects from the hybrid work model. Fewer people downtown have left retailers reeling. The Magnificent Mile’s vacancy rate stands at 29%, with the section furthest to the north around Water Tower Place — a vertical mall that once housed Macy’s Inc. — 39% empty, according to Cushman & Wakefield Plc. As Johnson takes office, he’ll have to tackle Chicago’s slow recovery from the pandemic, rising crime and empty buildings that are losing their value, which could reduce the amount of property tax the city collects in the long term. The 47-year-old Democrat appealed to voters in a largely progressive city. During his campaign, he pledged to raise taxes on major corporations in order to boost Chicago’s revenue, but business leaders say he’s been reaching out and is open to hear their arguments on why such a levy would drive companies away. “Mr. Johnson has no legal authority to impose a transaction tax on my business,” said CME’s Duffy, adding that fighting crime should be a bigger focus for the new mayor. “In our leases, we have a language in there that says if there’s something that’s ill-conceived from the city or the state, that our leases are null and void.” Johnson has met with various business leaders and has asked them to leverage their knowledge to help the city cut costs or raise more revenues, according to Jason Lee, a spokesman for the transition team. The incoming mayor understands the challenges the downtown is facing and is focused on revitalizing the Loop, as the central business district is known, he said. The city’s “downtown commercial corridors still bear the scars of the pandemic via higher vacancy rates and lower foot traffic,” Johnson said in his inauguration speech. He stressed the need to make the city’s public transportation system safer and more reliable so its residents could get to jobs as well as enjoy Chicago’s amenities. It’s not all bad news for Chicago. The West Loop and its Fulton Market district are booming, with a flurry of bars and restaurants serving employees at companies including Alphabet Inc.’s Google and McDonald’s Corp. High-quality buildings in the area command about $20 a square foot more than in the Loop, according to JLL’s Carolan. “Every single building that we’ve built in Fulton market is a 100% leased,” said Gloor of Sterling Bay, which is currently in the process of building another tower in the neighborhood. Chicago’s cheerleaders are also hopeful for the future of the Thompson Center, an underused 1980s government-owned building recently acquired by Google. The plan is for the building to be renovated and reopened in 2026. Yet back in the financial center, the value of the Cboe’s 400 South LaSalle building has already been cut by more than half because of two writedowns and depreciation, regulatory filings show. The company put the building up for sale almost four years ago to move to new headquarters in the renovated Old Post Office, while its trading floor relocated to the Chicago Board of Trade. Even if it gets a new owner, reviving downtown will take a lot more than a building sale. The more companies implement return-to-office polices, “the more bodies that come downtown,” said Brad Serot, vice chairman at CBRE. “That’s when you start to see busier streets, restaurants, cafes thriving again.” |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media