|

Housing market risks weigh on stock.

Redfin Corp. shares sank Wednesday as the outlook for the housing market weakens. Shares of the digital real estate company fell 8.5% Wednesday after Needham & Co Inc. analyst Bernie McTernan cut his housing market forecast for 2023 and lowered revenue estimates for Redfin and its peers Zillow Group Inc. and Compass Inc. McTernan said in a note Wednesday that he is “taking a more conservative approach” to Redfin’s future market share gains, especially in 2024. “We think management has the right sense of urgency to get the cost structure in the right spot (layoffs, price increase) but it is unclear how much further there is to go on these measures, making market growth and market share gains increasingly important,” McTernan wrote in a note. Total volume for US home sales is expected to be down 18% this year from a year ago, according to McTernan, who previously forecast a 10% decline. Higher mortgage rates and home prices have driven housing affordability to 15-year lows, according to the note. “Worsening macro conditions could put our estimates to the test, and worsen the affordability issues while housing supply remains tight,” the note said. “We think revenue growth is more necessary to drive Z and RDFN equity higher, and we think will be difficult with November and December existing home sales down YoY -36% and -37%, respectively,” McTernan wrote. Among the digital real estate companies, McTernan said Compass “remains top pick in the space,” citing the company’s recent cost-cutting efforts as helping. Compass rose 5.4%, while Zillow was down 5.3% Wednesday.

0 Comments

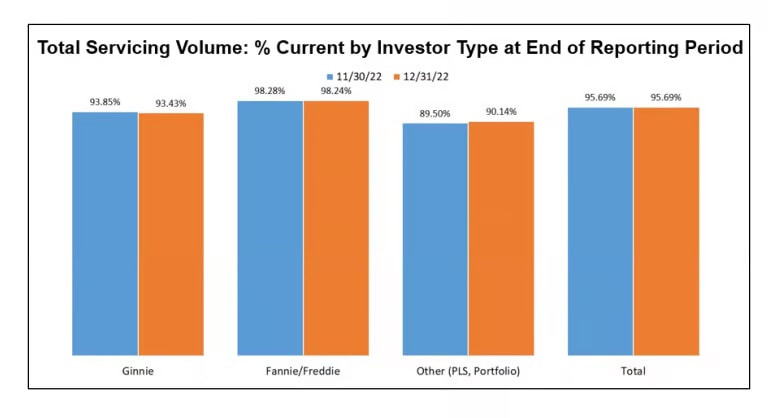

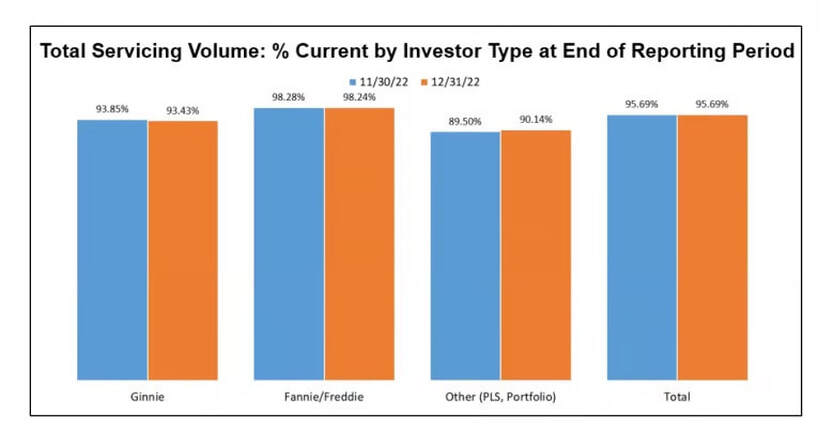

"Forbearance remains an option for struggling homeowners" The share of mortgage loans in forbearance has remained steady over the past few months – a sign that “forbearances have reached a floor on further improvements,” according to the Mortgage Bankers Association. MBA’s latest loan monitoring survey revealed that the total number of loans in forbearance remained unchanged at 0.70% as of Dec. 31, 2022. Based on the survey’s estimate, 350,000 homeowners are currently in forbearance plans. The share of Fannie Mae and Freddie Mac loans in forbearance dropped by one basis point to 0.31%. Ginnie Mae loans in forbearance also decreased by one basis point to 1.45%, while the forbearance share for portfolio loans and private-label securities (PLS) grew by three basis points to 1%. “For three consecutive months, the forbearance rate has remained flat — an indicator that we may have reached a floor on further improvements,” said Marina Walsh, vice president of industry analysis at MBA. “New forbearance requests and re-entries continue to trickle in at about the same pace as forbearance exits. The overall performance of servicing portfolios was also flat compared to the previous month, but there was some deterioration in the performance of Ginnie Mae loans.” Of the total loans in forbearance, 37.9% are in the initial forbearance plan stage, 49.3% are in a forbearance extension, and the remaining 12.8% are re-entries, including those with extensions. Total loans serviced that were current (not delinquent or in foreclosure) as a percentage of servicing portfolio volume hovered at 95.69% on a non-seasonally adjusted basis. “Forbearance remains an option for struggling homeowners, and its usage may continue, especially if unemployment increases, as expected,” Walsh said. “MBA is forecasting for the unemployment rate to reach 5.2% in the second half of 2023, up from its current level of 3.5%.” The MBA’s forecast for an increase in the unemployment rate in 2023 highlights the need for continued support for homeowners, such as forbearance plans, to ensure that they are able to keep their homes. NMHC survey shows decreased rents, fallen sales volume, and less availability of financing.

Apartment market conditions continue to worsen as recent interest rate hikes by the Federal Reserve take a toll on rents and make it more difficult for buyers to obtain debt and equity financing. The National Multifamily Housing Council (NMHC) recently released its quarterly market survey for January, which showed that apartment conditions have weakened. According to the survey, market tightness, sales volume, equity financing, and debt financing indexes all came in well below the break-even level of 50. NMHC’s chief economist Mark Obrinsky attributed the decrease in apartment rents nationwide to the Federal Reserve’s interest rate hikes. “The Fed’s interest rate hikes are having their intended effect on prices, as monthly apartment rents decreased nationwide,” Obrinsky said. He added that although rents are still higher than year-ago levels, this reflects past, not current rent inflation. NMHC’s sales volume index was also below the break-even level at 10. Around 82% reported lower sales volume, similar to last quarter. Only 2% reported an increase in sales volume, while 13% saw no change. The market tightness index for this quarter came in at 14, reflecting looser market conditions for two quarters in a row. The majority of respondents (78%) stated that the market is looser than it was three months ago, while only 5% reported it to be tighter. The remaining 16% saw no change in market conditions. Furthermore, the equity financing index reading of 20 marked the fourth consecutive quarter in which equity financing became less available. Nearly two-thirds (63%) of respondents reported equity financing was less available than three months ago. Similarly, the debt financing index reading of 25 indicated the sixth straight quarter in which debt financing became less available. About 60% of respondents reported that conditions have worsened for debt financing. “These rate hikes have also translated to a higher cost of debt financing, causing buyers to seek a higher rate of return,” Obrinsky said. “With sellers unwilling to budge much on pricing, apartment transaction volume has largely dried up.” Existing home sales are sagging...

Existing home sales in December sagged to their lowest level since November 2010, with sales retreating for the 11th consecutive month, according to the National Association of Realtors. However, experts have grown more optimistic and predict a more balanced housing market this 2023. NAR’s latest report showed total existing-home sales dropped 1.5% from November to a seasonally adjusted annual rate of 4.02 million in December. Year-over-year, sales plunged 34%, down from 6.09 million in December 2021. NAR chief economist Lawrence Yun explained that December was a difficult month for buyers, who continue to face limited inventory and high mortgage rates. Despite the new record low, NerdWallet home and mortgage expert Holden Lewis stressed that the real estate market in 2022 was very different from 12 years ago. “December’s sales were slow because high mortgage rates make homes unaffordable for many would-be buyers,” he said. “In 2010, the market was clawing its way out of the Great Recession. Home prices have declined modestly each month since June, but a dramatic plunge in prices — a housing crash — seems unlikely because not many houses are for sale, and there has not been a collapse in demand from buyers.” The median existing-home price for all housing types in December was $366,900, up 2.3% from $358,800 in December 2021, as prices rose in all regions. This marks the longest-running streak of year-over-year increases on record (130 consecutive months). “Home prices nationwide are still positive, though mildly,” Yun said. “Markets in roughly half of the country are likely to offer potential buyers discounted prices compared to last year.” Total housing inventory registered at the end of December was 970,000 units, a 13.4% decline from November but up 10.2% from one year ago (880,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.3 months in November but up from 1.7 months in December 2021. Yun expects sales to pick up again soon due to the easing prices and the continuous decline in mortgage rates. According to Freddie Mac, the benchmark 30-year fixed-rate mortgage averaged 6.15% as of January 19. That’s down from 6.33% last week but up from 3.56% the year prior. But uptick in housing completions indicates easing in supply chain issues and labor shortages.

The US housing market continued to show signs of weakness as building permits, and housing starts declined further in December. The Census Bureau reported Thursday that housing starts in December fell 1.4% month over month and 21.8% year over year to a seasonally adjusted annual rate of 1.38 million units. “New home starts declined in December, as the housing market continued to show signs of tightening,” said Kelly Mangold, principal at RCLCO Real Estate Consulting. The decline in overall housing starts was led by a 19% plunge in multifamily production, down to a 473 pace in December. On the bright side, single-family housing starts posted an 11.3% gain to 909,000. However, homebuilder Jerry Konter noted that single-family production is running well below a one million-unit rate, indicating ongoing weakness in the housing market as high construction costs and elevated interest rates continue to present affordability challenges. “Even though single-family starts are up on a monthly basis, permits indicate that the housing market will slow down further in 2023,” said Konter, chairman of the National Association of Home Builders (NAHB). “We expect a sustainable decline for mortgage rates in the second half of this year, which should lead to a housing recovery in 2024.” The report also shows that an estimated 1.33 million housing units were authorized by building permits in December, 1.6% below the November figure of 1.35 million and 29.9% below the December rate of 1.90 million. Single-family authorizations in December were at a 730,000 pace, 6.5% below the revised November figure of 781,000. Multifamily permits were at a rate of 555,000 in December. “The decline in single-family permits indicates that builders are slowing construction activity as interest rates have spiked in recent months,” said Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis. “Starts began on a strong footing in early 2022 but fell back in the latter part of the year as higher costs led to a pause in home building activity, and affordability conditions worsened for home buyers.” While December housing starts and permits were lower year-over-year, NerdWallet home expert Kate Wood highlighted the 6.4% increase in housing completions – perhaps signaling easing in supply chain issues and labor shortages. “Compared to November, fewer permits were issued for single-family homes and two-to-four unit dwellings, but permits for housing with five-plus units rose 7.1%,” Wood said. “Whether those multifamily units end up for sale or rent, increased inventory could help relieve some of the affordability strains currently faced by both renters and homebuyers.” “The combination of slightly reduced mortgage rates and discounts and specials on for-sale pricing may bring more buyers to the market, especially after the historically slow holiday season is over – and as spring buying season approaches,” Mangold added. “Inflation is also beginning to decline, and the job market remains relatively strong – so it will be interesting to track how the housing market continues to react in the early part of 2023.” "The resulting affordability pressures are evident in the home price declines of the past two quarters"

Single-family home prices in the United States increased at a non-seasonally adjusted annual rate of 9.2% in Q4 2022, according to the latest Home Price Index (FNM-HPI) reading from Fannie Mae. This marks a decrease from the previous quarter’s annual growth rate of 13.1%. On a quarterly basis, home prices rose a seasonally adjusted 0.2%, just above the 0.1% growth seen in the previous quarter. However, on a non-seasonally adjusted basis, home prices declined by 1.0% in Q4 2022. Mark Palim, Fannie Mae vice president and deputy chief economist, attributes the recent decline in home prices to the rise in mortgage rates over the past year and record inflation, which has constrained the purchasing power of prospective homebuyers. “The resulting affordability pressures are evident in the home price declines of the past two quarters, along with the downturn in home sales,” Palim said. “The rise in rates also exacerbates the ‘lock-in effect’ in which existing homeowners who have rates well below current market rates have a financial disincentive to give up their current mortgage and purchase a different home at a higher mortgage rate, thereby reducing the supply of homes available for sale.” Palim believes the tension between lower mortgage demand and low supply and how it is resolved will hugely impact home prices in 2023. The FNM-HPI measures the average quarterly price change for all single-family properties in the US, excluding condos. Fannie Mae aggregates county-level data to create both seasonally adjusted and non-seasonally adjusted national indices to gauge general single-family home price trends. Tenure was marked by high-profile decisions.

With a March trial date quickly approaching in the federal perjury case against Baltimore’s former top prosecutor Marilyn Mosby, a series of rulings Tuesday created significant new hurdles for her defense team, including the possibility of criminal contempt charges against her lead attorney. Mosby left office earlier this month after serving two terms as Baltimore state’s attorney - a tenure defined by several high-profile decisions, including prosecuting the police officers involved in Freddie Gray’s 2015 death and dismissing the charges against Adnan Syed, whose case was featured on the hit podcast “Serial.” Mosby, who frequently touted her progressive policies, was defeated in a Democratic primary last year after federal prosecutors accused her of lying about experiencing pandemic-related financial hardship in order to make early withdrawals from her retirement account. She used the money to buy two Florida vacation properties. Her lead defense attorney, A. Scott Bolden, has also violated several court rules in recent months, U.S. District Court Judge Lydia Kay Griggsby said during a pretrial hearing Tuesday. The violations include statements he made to news reporters outside the Baltimore courthouse following a September court appearance, when Bolden used profanity and suggested the prosecution had racial animus. He publicly apologized the following day. Griggsby also issued a limited gag order in the case Tuesday, largely in response to the statements from Bolden and other missteps from the defense team. She said the main goal is protecting the integrity of the upcoming jury selection process. “We should be talking about the information in the public record - the facts,” she said. The gag order forbids lawyers involved in the case from making statements to the media and releasing any information that has “a reasonable likelihood” of creating prejudice or unfairness. In requesting the gag order, prosecutors accused Bolden of spewing falsehoods from the courthouse steps. Bolden said he never intended to break the rules or jeopardize the integrity of the proceeding. “It came from my heart and not my head,” he told the judge. “Clearly, it was not my finest hour.” Mosby’s trial is scheduled to begin March 27 in Baltimore. She faces two counts each of perjury and mortgage fraud. Her attorneys had requested the trial be moved to Greenbelt, Maryland, arguing that “pervasive negative pretrial publicity” in Baltimore would make it virtually impossible to seat an impartial jury there. Griggsby denied the request on Tuesday. “Notoriety alone is not enough to justify changing a venue,” she said, noting jurors would be chosen from an area that spans half of Maryland, not just Baltimore. However, she didn’t dismiss the concerns entirely, saying defense attorneys could raise them again later on. Mosby’s defense team suffered another blow when Griggsby announced she’s considering holding Bolden in criminal contempt of court. In addition to his statements from the September press conference, Griggsby said, Bolden violated court rules by disclosing confidential responses from potential jurors in a recent filing. Bolden, who’s based in Washington, D.C., also failed to get the motion signed by an attorney licensed to practice in Maryland, the judge said. Griggsby gave him a Jan. 31 deadline to argue why he shouldn’t receive criminal contempt sanctions, which can include fines or limited jail time. Bolden could also be pulled from the case. Since leaving elected office, Mosby has declined to share her future plans. Her husband, Baltimore City Council President Nick Mosby, was present at the hearing Tuesday. In 2020, Mosby submitted requests for one-time withdrawals of $40,000 and $50,000, respectively, from Baltimore’s deferred compensation plans, according to her indictment. Prosecutors allege Mosby falsely certified that she experienced financial hardship because of the coronavirus, but she actually received her nearly $250,000 salary in 2020. Her attorneys have argued that COVID-19 had an impact on both financial markets and Mosby’s personal travel and consulting businesses. They’ve accused prosecutors of having racial or political motives for pursuing the case, though Griggsby previously rejected their assertion of vindictive prosecution. The indictment also alleges that in 2020 and 2021, Mosby made false statements in applications for a $490,500 mortgage to purchase a home near Disney World in Kissimmee, Florida, and a $428,400 mortgage to purchase a condominium in Long Boat Key, Florida. She failed to disclose federal tax debt and misled lenders about her intentions for the property near Disney World, saying it would serve as a second home when she actually was making arrangements to rent it out, according to the indictment. "Equities and housing move in sync with interest rates".

Global housing markets will face significant declines this year and next as interest rates stay high, according to Harvard University Professor Kenneth Rogoff. The former International Monetary Fund chief economist, speaking on Bloomberg Television at the World Economic Forum in Davos, suggested that borrowing costs are likely to keep rising a bit further to quell inflation, further depressing real-estate prices. “Equities and housing move in sync with interest rates — but equities move much faster,” he told Lisa Abramowicz. “If, as I think, interest rates are going to stay high for some time to come, I think there’s still a lot of downward adjustment in housing markets globally, not just in the United States.” Asked for a more precise outlook on the drop in real-estate prices, Rogoff predicted “certainly another 10% I would think, over a couple of years.” With benchmark borrowing costs rising throughout the world, housing markets from Canada to Sweden have gone into sharp reverse with no sign of a letup. The pressure on housing markets is likely to persist as global central banks keep monetary policy tight, led by the US Federal Reserve. “Inflation will eventually come down — maybe just to 2.5%, not to 2% — but interest rates aren’t going to come down to the same level as they were before,” Rogoff said. “I wouldn’t be surprised to have a Fed funds rate of 3.5% for quite a while from now.” It's the DOJ's largest ever.

The Justice Department accused Los Angeles-based City National Bank on Thursday of discrimination by refusing to underwrite mortgages in predominately Black and Latino communities, requiring the bank to pay more than $31 million in the largest redlining settlement in department history. City National is the latest bank in the past several years to be found systematically avoiding lending to racial and ethnic minorities, a practice that the Biden administration has set up its own task force to combat. The Justice Department says that between 2017 and 2020, City National avoided marketing and underwriting mortgages in majority Black and Latino neighborhoods in Los Angeles County. Other banks operating in those neighborhoods received six times the number of mortgage applications that City National did, according to federal officials. The Justice Department alleges City National, a bank with roughly $95 billion in assets, was so reluctant to operate in neighborhoods where most of the residents are people of color, the bank only opened one branch in those neighborhoods in the past 20 years. In comparison, the bank opened or acquired 11 branches in that time period. In addition, no employee was dedicated to underwriting mortgages at that one branch, unlike branches in majority white neighborhoods. “This settlement should send a strong message to the financial industry that we expect lenders to serve all members of the community and that they will be held accountable when they fail to do so,” Assistant Attorney General Kristen Clarke, who leads the Justice Department’s civil rights division, said in a statement. Attorney General Merrick Garland has prioritized civil rights prosecutions since taking the helm at the Justice Department in 2021 and the department, in the Biden administration, has put a higher priority on redlining cases than under previous administrations. The Biden task force includes the Justice Department as well as bank regulators like the Comptroller of the Currency and the Consumer Financial Protection Bureau, and is focused not only on explicit forms of redlining but also cases where computer algorithms may cause banks to discriminate against Black and Latino borrowers. Despite a half-century of laws designed to combat redlining, the racist practice continues across the country and the long-term effects are still felt to this day. The average net worth of a Black family is a fraction of a typical white household, and homes in historically redlined neighborhoods are still worth less than homes in non-redlined communities. As part of the settlement, City National will create a $29.5 million loan subsidy fund for loans to Black and Latino borrowers, and spend $1.75 million on advertising, community outreach and financial education programs to reach minority borrowers. In a statement, City National said it disagreed with the Justice Department’s allegations, but that it will “nonetheless support the DOJ in its efforts to ensure equal access to credit for all consumers, regardless of race.” The Justice Department said City National cooperated as part of the redlining investigation and is working to resolve its issues in other markets, as well. Clarke announced the settlement Thursday morning at a historic Black Baptist church in South Los Angeles that was an important force in the civil rights movement and has been the venue for speeches by the Rev. Martin Luther King Jr., Malcolm X and others. The settlement with City National is the largest settlement with the Justice Department. A settlement with the Department of Housing and Urban Development with Associated Bank in 2015 involved the bank making a commitment to make $200 million in increased lending in minority-majority neighborhoods, along with a $10 million subsidy fund similar to the one agreed to by City National. Report reveals why repossession remains low despite rise in foreclosure activity.

Foreclosure filings on US properties in 2022 were up 115% from 2021, according to the year-end 2022 Foreclosure Market Report from ATTOM. Properties with foreclosure filings represented 0.23% of all US housing units, up slightly from 0.11% in 2021 but down from 0.36% in 2019 and a peak of 2.23% in 2010. “Eighteen (18) months after the end of the government’s foreclosure moratorium, and with less than 5% of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic,” said Rick Sharga, executive vice president of market intelligence at ATTOM. Sharga attributes this to government and mortgage industry efforts during the pandemic, coupled with a strong economy, which helped prevent millions of unnecessary foreclosures. The report also showed there were 30,822 properties with foreclosure filings, an increase of less than 1% from the previous month and a 72% surge from a year ago. In December 2022, one in every 4,558 properties had a foreclosure filing nationwide. But unlike foreclosure activity during the Great Recession, the majority of homes in foreclosure are not being repossessed by lenders, Sharga noted. “Our recent homeowner equity report shows that 93% of borrowers in foreclosure today have positive equity, which they appear to be leveraging in order to avoid a foreclosure by refinancing their mortgage or selling the property at a profit,” he said. “It seems likely that this is a trend that will continue in 2023.” |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media