|

NAR releases its latest data.

US pending home sales in May fell to the lowest level this year as high mortgage rates and inventory constraints continue to impact sales. The National Association of Realtors’ index of contract signings to purchase previously owned homes dropped 2.7% to 76.5 last month, according to data released Thursday. The decrease was bigger than all but one estimate in a Bloomberg survey of economists. The resale market continues to face headwinds as high borrowing costs and low supply weigh on sales. Many homeowners who locked in lower mortgage rates in the past are reluctant to move, adding to inventory constraints that are pushing many buyers into the new-home market and helping keep existing-home sales subdued. “The lack of housing inventory continues to prevent housing demand from being fully realized,” Lawrence Yun, NAR’s chief economist, said in a statement. “It is encouraging that homebuilders have ramped up production, but the supply from new construction takes time and remains insufficient.” The pending home sales report is often seen as a leading indicator of existing-home sales given homes typically go under contract a month or two before they’re sold. Sales declined in three of four regions, with transactions in the Midwest falling to the lowest level since April 2020. From a year earlier, US home purchases were down nearly 21% on an unadjusted basis.

0 Comments

Uncovering the struggles faced by Americans in achieving homeownership.

According to a survey conducted by Divvy Homes, two out of five Americans believe that winning the lottery is their only chance at becoming homeowners. The survey, conducted among 2,000 current non-homeowners, revealed that only 53% of respondents have any confidence in their ability to own a home in the future. In addition to the 40% who would rely on winning the lottery, 26% feel they would need to inherit money, and 19% believe they would have to marry someone wealthy to reach their dream of homeownership. On average, Americans estimate that it would take them between three to four years to afford a home, while 20% believe that homeownership will never be within their reach. The survey also found that 57% of non-homeowners would struggle to afford a house in their current neighborhood. Despite these challenges, 67% of respondents remain hopeful about the possibility of owning a home, while 12% describe themselves as hopeless, 19% as frustrated, and 11% as desperate. The survey also highlighted the impact of market dynamics and rising interest rates on potential buyers. While 52% perceive the current housing market as unstable, 46% believe it will stabilize within the next two to five years, while 17% think it will never return to a stable and affordable state. Respondents estimate that they would need an average annual income of $76,000 to afford a starter home, with a minimum of $45,000 in savings for the downpayment. The ideal downpayment size, according to respondents, would be 8% of the overall purchase price, making their ideal home worth just under $570,000. To get closer to their homeownership goal, 44% of respondents are willing to take on a second job or side gig. Among those hoping to buy a home in the next few years, affordability of monthly payments (69%), the right size of the home for present and future needs (39%), and an ideal location for their family (37%) are key priorities. However, 56% of respondents believe they would be denied if they applied for a mortgage at present. “Potential buyers are looking for alternatives to traditional mortgage financing or are stuck waiting for a reprieve from the rising rates and prices that keep so many of them renting and locked out of homeownership,” said Adena Hefets, co-founder and CEO of Divvy Homes. “There are so many factors putting downward pressure on a potential homeowner’s buying power - high interest rates, a lack of supply, increasing cost-of-living - that the starter home seems to be on the verge of extinction.” The survey also revealed concerns among renters, with 47% worried about rising home prices before they can afford to buy. Additionally, “throwing money away on rent” (46%), uncertainty about long-term housing stability (41%), and the impact of rising interest rates (34%) were identified as the biggest drawbacks to not owning a home. “The traditional mortgage process was designed in the 1940s when the norm was a single breadwinner with a steady W-2 income. The system hasn’t changed, even though the way we work, live and form families is dramatically different. But today’s younger buyers often lack long periods of income history and are increasingly non-salaried, working as a 1099 contractor, gig worker, or self-employed individual,” Hefets said. “A majority of aspiring homebuyers feel that homeownership is always just beyond their reach, that the ‘American Dream’ of homeownership is slipping away, and that it would take luck, extraordinary circumstances, or a serious change in the mortgage process to make it possible for them to own a home in today’s economic climate.” People are still deterred from moving.

The number of homes for sale in the US fell to record low levels in May, according to real estate brokerage Redfin Corp., as high mortgage rates continue to deter people from moving. Active listings fell 7.1% on a seasonally adjusted basis in May, and were down 38.6% from pre-pandemic levels, according to Redfin’s Housing Market Tracker. The brokerage said just 1.4 million homes were up for sale in May — lower than any month on its records, which date back to 2012. Many homeowners are opting to stay put as moving means giving up a cheaper mortgage. Rising interest rates pushed the average 30-year-fixed rate to 6.43% in May, Redfin said, up from 5.23% a year earlier, and more than double the 2.65% rate in May 2021. The low number of homes for sale has driven price increases in some markets. Nearly half of Redfin’s offers were met with bidding wars in May, while more than two-thirds of homes sold went for above list price. But new builds could help alleviate those high prices, and the listings scarcity. US housing starts unexpectedly reached their highest level since 2016 in May, according to government data. Existing home sales are set to be announced on Thursday. They likely decreased slightly in May to an annualized pace of 4.25 million, from April’s 4.28 million, according to Bloomberg Economics. Is the banking system well capitalized?

The top US financial regulators say they are stepping up scrutiny of how exposed banks are to commercial real estate, as vacancy rates increase. The Financial Stability Oversight Council said in a statement Friday that delinquency rates are low, but empty offices are on the rise. The group, which was set up after the global financial crisis, includes the heads of the Treasury Department, the Federal Reserve and the Securities and Exchange Commission. “Regulators are taking steps to emphasize risk management and examine exposures to CRE loans at their regulated institutions,” the group said. After several wild months in finance during which three midsize banks failed, Washington’s watchdogs are under pressure to get in front of any looming issues. During their Friday meeting, the regulators discussed “the ability of market participants to manage their interest-rate risk and liquidity risk in the current economic environment,” the group said. Overall, the group, which is known as FSOC, said that the banking system was “well capitalized.” The Fed and the Federal Deposit Insurance Corp. have been peppering lenders with questions related to interest-rate risks and commercial real estate exposure, Bloomberg News reported last month. Federal Chair Jerome Powell on Wednesday said “we do expect that there will be losses” in commercial real estate, and banks that have concentrations in that area will experience bigger losses. They are down around 10%.

Lennar Corp., the second-largest US homebuilder, is calling an end to falling housing prices — but doesn’t yet see a recovery in sight. “Home prices have come down about 10%,” executive chairman Stuart Miller said Thursday in a Bloomberg Television interview. “They’re probably going to remain right there at least for the foreseeable future.” He qualified that assessment by saying his outlook was subject to change in the event of interest rates moving higher, a day after Miami-based Lennar reported quarterly earnings and the Federal Reserve announced a pause in its hiking cycle. A chronic shortage of affordable housing units in the US will keep the market tight, Miller said. Investors may be signaling that their concerns about homebuilding are easing. Lennar is heading for its highest close on record, eclipsing the $116.91 mark set in December 2021. The shares rose 3.7% to $119 at 2:23 p.m. in New York, buoyed by Lennar’s boost in its forecast for full-year new-home deliveries and quarterly beats against estimates for gross margins and new orders. Miller said on an earnings call that the average sales price of a new Lennar home was now $450,000, down from a peak of $500,000 last year. The exuberant demand that marked the COVID-19 pandemic has withered under the pressure of the fastest rate-hiking cycles in Fed history, crimping prices. Inventory of existing houses has evaporated as owners choose to stay put rather than move and borrow at higher rates, and builders have benefited as new buyers enter the market. Still, lower prices have dented Lennar’s profitability, a metric Miller said is likely to remain lower than it once was. New homeowners, including young people who have lived at home with their parents, have become the principal drivers of demand for Lennar homes, Miller said, while “those that have that 3%, 4% mortgage are going to be very reluctant to give up that interest rate.” They are down around 10%.

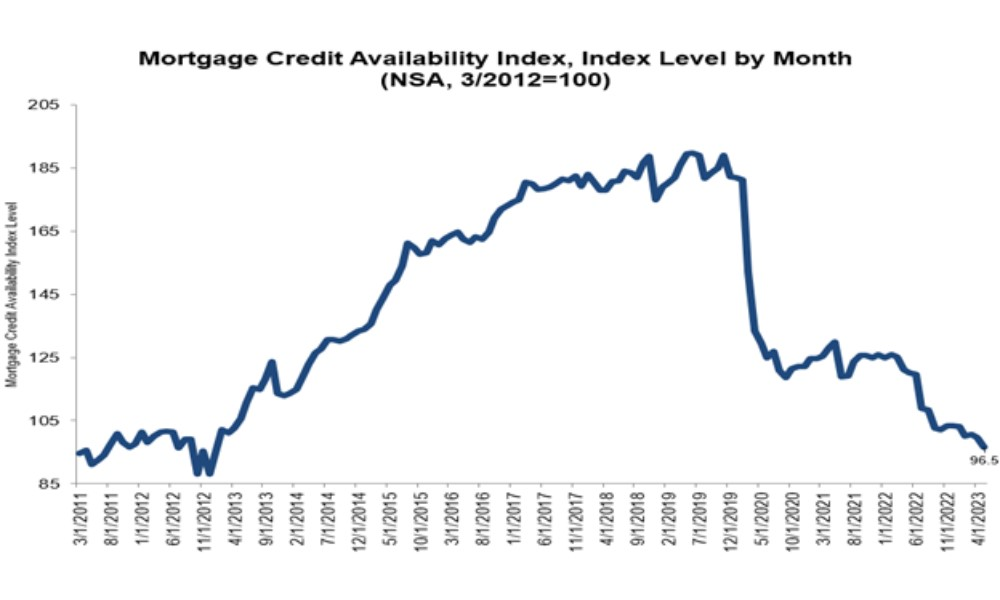

Lennar Corp., the second-largest US homebuilder, is calling an end to falling housing prices — but doesn’t yet see a recovery in sight. “Home prices have come down about 10%,” executive chairman Stuart Miller said Thursday in a Bloomberg Television interview. “They’re probably going to remain right there at least for the foreseeable future.” He qualified that assessment by saying his outlook was subject to change in the event of interest rates moving higher, a day after Miami-based Lennar reported quarterly earnings and the Federal Reserve announced a pause in its hiking cycle. A chronic shortage of affordable housing units in the US will keep the market tight, Miller said. Investors may be signaling that their concerns about homebuilding are easing. Lennar is heading for its highest close on record, eclipsing the $116.91 mark set in December 2021. The shares rose 3.7% to $119 at 2:23 p.m. in New York, buoyed by Lennar’s boost in its forecast for full-year new-home deliveries and quarterly beats against estimates for gross margins and new orders. Miller said on an earnings call that the average sales price of a new Lennar home was now $450,000, down from a peak of $500,000 last year. The exuberant demand that marked the COVID-19 pandemic has withered under the pressure of the fastest rate-hiking cycles in Fed history, crimping prices. Inventory of existing houses has evaporated as owners choose to stay put rather than move and borrow at higher rates, and builders have benefited as new buyers enter the market. Still, lower prices have dented Lennar’s profitability, a metric Miller said is likely to remain lower than it once was. New homeowners, including young people who have lived at home with their parents, have become the principal drivers of demand for Lennar homes, Miller said, while “those that have that 3%, 4% mortgage are going to be very reluctant to give up that interest rate.” "The depressed supply of government credit is particularly significant". Mortgage supply fell again in May against the backdrop of an industry facing a period of consolidation and reduced capacity, according to the Mortgage Bankers Association. MBA’s Mortgage Credit Availability Index (MCAI) tumbled 3.1% month over month to 96.5 in May, marking the third-straight month of declines and a tightening in lending standards. “Mortgage credit availability decreased for the third consecutive month, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market,” said Joel Kan, MBA’s deputy chief economist. “With this decline in availability, the MCAI is now at its lowest level since January 2013.”

The Conventional MCAI dropped 2.3%, while the Government MCAI fell 3.8% in May. Of the component indices of the Conventional index, the conforming MCAI slipped 3.9% to its lowest level in the survey’s history dating back to 2011. According to Kan, the jumbo index saw a 1.5% decrease, its first contraction in three months as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans. “Additionally, lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan applications continued to run well behind last year’s pace,” Kan explained. “Both conventional and Government indices saw declines last month, and the Government index fell by 3.8% to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers, the depressed supply of government credit is particularly significant.” But affordability index is still well below the breakeven point of 50.

Housing affordability showed signs of easing in the first quarter, according to the National Association of Home Builders (NAHB). The NAHB)/Wells Fargo Housing Opportunity Index (HOI) improved by 38.1% from the Q4 2022 reading, the lowest level since 2012, thanks to lower home prices and solid wage gains. HOI data showed that the national median home price declined to $365,000 in the first quarter from $370,000 in the previous quarter. Additionally, long-term mortgage rates averaged 6.46% in Q1, down from a series-high of 6.80% in Q4. The US median family income jumped 7% from $90,000 in 2022 to $96,300 in 2023. The quarterly HOI increase brings the share of new and existing homes affordable to families earning the US median income of $96,300 to 45.6% of all homes sold in Q1. However, the index remained significantly lower compared to the first quarter 2022 reading of 56.9%, a reminder of ongoing building material supply chain issues and other affordability challenges. “Elevated interest rates and higher home prices coming out of the pandemic have left housing affordability conditions considerably lower on a year-over-year basis,” said NAHB chief economist Robert Dietz. “While affordability posted a gain in the first quarter, it is still well below the breakeven point of 50. The lack of housing units is the primary cause of the nation’s housing affordability challenges, and the best way to reduce housing costs and fight inflation is to put into place policies that will allow builders to construct more attainable housing.” “An uptick in housing affordability in the first quarter of 2023 corresponds to a rise in builder sentiment over the same period as well as an increase in single-family permits,” said NAHB chairman Alicia Huey. “And while buyer conditions improved at the beginning of the year, builders continue to wrestle with a host of affordability challenges. These include a shortage of distribution transformers and concrete that are delaying housing projects and raising construction costs, a lack of skilled workers, and tightening credit conditions.” They are under serious pressure.

The stock market is growing more sanguine about US regional banks, but the lenders still face serious pressure. A credit “contraction is invariably coming,” Soros Fund Management Chief Executive Officer Dawn Fitzpatrick said at this week’s Bloomberg Invest conference, adding that additional banks will fail because “there are more problems under the surface.” One further source of trouble for the industry will be commercial real estate, an area that in recent years smaller and regional banks have become a bigger force in. Working from home has cut into office values and almost $1.5 trillion of commercial property debt is due for repayment before the end of 2025. Meanwhile, rising interest rates have made many properties less valuable. “US banks have become much more vulnerable to a decline in commercial real estate prices,” Torsten Slok, chief economist at Apollo Global Management Inc., wrote in an email to clients this week. The upshot is that 700 US banks now exceed the Federal Deposit Insurance. Corp.’s guidance from 2006 on commercial real estate loan concentration, he calculated. Two years ago, it was less than half that number. There were about 4,700 FDIC insured US banks as of the end of March. The guidelines were introduced in 2006 to address loan concentration and risk management deficiencies among banks in relation to commercial property loans. Those who exceed them are potentially subject to greater supervisory scrutiny, including higher capital levels and heightened risk management practices. The FDIC declined to comment. Its chairman Martin Gruenberg said last month that potential problems with property portfolios will be a matter of “ongoing supervisory attention” and that “despite the recent period of stress, the banking industry has proven to be quite resilient.” Small minnows Some banks are already shrinking their exposure to commercial real estate. PacWest Bancorp, one of the US lenders engulfed in the commotion, is selling a $2.6 billion portfolio of real estate construction loans to shore up liquidity. “The small minnows” have the “lion’s share of the exposure,” Monsur Hussain, head of research for global financial institutions at Fitch Ratings, said on a webinar this week. “They have approximately 14% of their total assets in CRE exposures, but it can be as high as over 40% of their total assets.” Any further regional bank failures would likely make credit even more difficult to access for property developers and landlords, especially those who are smaller or lower quality. The headwinds mean office values are now down 27% on average from their recent peak after falling further in the past month, according to Green Street. The average commercial property is down 15%. “There’s not much transacting these days because buyers and sellers can’t seem to agree on pricing,” Peter Rothemund, co-head of strategic research at the firm, said in a report this week. “These situations eventually resolve themselves, and usually it’s in favor of the buyers.” The trouble is also beginning to feed through to the commercial mortgage-backed securities market where about $140 billion of the assets are due to mature this year. In recent years, an increasing portion of the loans that were packaged into CMBS were interest only, according to data compiled by Trepp. More than 4% of office loans packaged into the securities were at least 30 days in arrears as of May, according to a recent report by the real estate data firm. That’s the highest level since 2018. “We expect commercial real estate more broadly to remain under pressure given the immediacy of the maturity wall at a time where the single-largest lender – regional banks – is experiencing an elevated rate of scrutiny,” Morgan Stanley analysts including Jay Bacow wrote this week. Monthly increase signals possibility of continued heightened activity.

The US housing market saw heightened foreclosure activity in May, as widely anticipated, according to ATTOM’s latest report. Foreclosure filings (default notices, scheduled auctions, or bank repossessions) surged 7% from April and were up 14% from a year ago to 35,196 properties across the country. Of that figure, lenders repossessed 4,020 properties through completed foreclosures (REOs) in May, a 38% increase from the previous month and up 41% from May 2022. “The recent increase in foreclosure filings nationwide indicates a trend that has been observed throughout the year and what we have expected to occur,” said Rob Barber, CEO at ATTOM. “This upward trajectory suggests the possibility of continued heightened activity, and with foreclosure completions seeing the largest monthly increase this year, we will continue to monitor the potential impacts this may have on the housing market.” According to the report, one in every 3,967 housing units had a foreclosure filing in May. States with the highest foreclosure rates were Illinois (one in every 2,144 housing units with a foreclosure filing), Maryland (one in every 2,203 housing units), New Jersey (one in every 2,257 housing units), Florida (one in every 2,470 housing units), and Ohio (one in every 2,478 housing units). Foreclosure starts increased 4% month over month and 5% year over year to 23,245 properties in May. Florida had the greatest number of foreclosure starts (2,901 foreclosure starts), followed by California (2,451 foreclosure starts), Texas (2,286 foreclosure starts), Illinois (1,358 foreclosure starts), and New York (1,287 foreclosure starts). |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media