|

iMove has just listed an amazing new loft in Edgewater located at 1128 W Ardmore in Chicago's Edgewater neighborhood. The unit is a resale from the conversion project known as Substation Lofts. The building was formerly a ComEd substation. Many features from the building's prior life are retained giving it a truly unique profile. This unit boast a soaring living room of over 18', enormous triple pane windows, hardwood floors, and all the other features you would expect in a high-end home. Two bedrooms and two bathrooms. All for the bargain price of $339,000. (When this unit was originally listed by the developer the price was nearly $500,000. The market's change is your opportunity. Call for a private showing today. Here are some of the photos we took today...

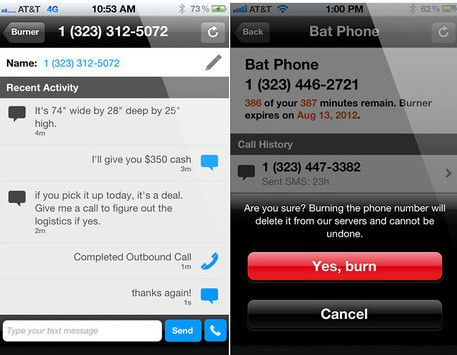

From Ad Hoc Labs comes Burner App. It provides you with a temprary phone number for incoming and outgoing calls along with SMS tweets. Each phone number can be turned on or sent directly to a discreet, professional voicemail. More importantly, each number can be erased or transferred to your real number at your whim. That cute girl you met at the club who brought her two cats, Mr. Snuggles and Captain Booberry, on your first dinner date? Yea, that’s a burner. Three credits (two bucks) gives you a Burner number that lasts for 20 minutes of talk, 60 texts, or 7 days. Additional credits can be purchased to extend your use of individual numbers or add multiple burn lines: 8 credits for $5, 15 for $8, and 25 for $12. Burner won’t hide illegal activities from the local constabulatory/FBI/NSA, but good-natured crank calls, inebriated hook-ups, juggling multiple hook ups or job searches while at work just become safer. There is an increasing number of people who are willing to use mobile apps to order meals and make reservations, according to a report from the National Restaurant Association (NRA). To feed this growth, a wide array of mobile apps are being developed.

I’ve sifted through hundreds of these apps and drew up a list of six that I’m most excited about. Check out a brief description about what each app does below. For a more in depth look, read my full article on the Software Advice blog: 6 Mobile Apps Restaurant Owners Should Know About. 1. ChowNow ChowNow is a simple, easy to use online ordering platform. ChowNow gives a customer the ability to place an order through a restaurant’s website, Faebook page, or ChowNow powered mobile app. 2. Tabbedout Tabbedout is a mobile payment application. With Tabbedout, all the customer has to do is enter in their information and hit “Open Tab”. From there, the customer can manage and pay for their tab all from their smartphone. 3. Diner Connection Diner Connection is a wait-list manager. Diner Connection lets hosts communicate with customers via text message. It also allows staff to get rid of all those pesky pagers! 4. Uncorkd Uncorkd is a wine menu app that works for the iPad. With Uncorkd, a restaurant owner can enter in their entire collection of wines onto the app, including extra information like origin, age, and complementary food pairings. From there, they simply hand the iPad to their customers with the normal menu. 5. GoPago GoPago is a mobile ordering app that lets customers skip the line entirely! With GoPago, customers can use their smartphone to browse, order, and pay for food on-the-go. 6. Belly Belly is a digital rewards program that gives customers the ability to earn points every time they scan their Belly card or QR code in a restaurant. Once they hit a certain number of points, they can claim a reward determined by the restaurant owner. Ellen Brown answers that question in her latest article:

SAVING THE POST OFFICE: LETTER CARRIERS CONSIDER BRINGING BACK BANKING SERVICES On July 27, 2012, the National Association of Letter Carriers adopted a resolution at their National Convention in Minneapolis to investigate the establishment of a postal banking system. The resolution noted that expanding postal services and developing new sources of revenue are important components of any effort to save the public Post Office and preserve living-wage jobs; that many countries have a long and successful history of postal banking, including Germany, France, Italy, Japan, and the United States itself; and that postal banks could serve the 9 million people who don’t have a bank account and the 21 million who use usurious check cashers, giving low-income people access to a safe banking system. “A USPS bank would offer a ‘public option’ for banking,” concluded the resolution, “providing basic checking and savings – and no complex financial wheeling and dealing.” What is bankrupting the USPS is not that it is inefficient. It has been self-funded throughout its history. But in 2006, Congress required it to prefund postal retiree health benefits for 75 years into the future, an onerous burden no other public or private company is required to carry. The USPS has evidently been targeted by a plutocratic Congress bent on destroying the most powerful unions and privatizing all public services, including education. Britain’s 150-year-old postal service is on the privatization chopping block for the same reason, and its postal workers have also vowed to fight. Adding banking services is an internationally tested and proven way to maintain post office solvency and profitability. Serving an Underserved Market Without Going BrokeMany countries operate postal savings systems through their post offices, providing depositors without access to banks a safe, convenient way to save. Great Britain first offered this arrangement in 1861. It was wildly popular, attracting over 600,000 accounts and £8.2 million in deposits in its first five years. By 1927, there were twelve million accounts—one in four Britons—with £283 million on deposit. Other postal banks followed. They were popular because they serviced a huge untapped market—the unbanked and underbanked. According to a Discussion Paper of the United Nations Department of Economic and Social Affairs: The essential characteristic distinguishing postal financial services from the private banking sector is the obligation and capacity of the postal system to serve the entire spectrum of the national population, unlike conventional private banks which allocate their institutional resources to service the sectors of the population they deem most profitable. Serving the unbanked and underbanked may sound like a losing proposition, but numerous precedents show that postal savings banks serving low-income and rural populations can be quite profitable. (See below.) In many countries, according to the UN Paper, banking revenues are actually crucial to maintaining the profitability of their postal network. Letter delivery generates losses and often requires cross-subsidies from the post’s other activities in order to maintain its network. One effective solution has been to create or expand the role of postal financial services. One reason public postal banks are profitable is that their costs are low: the infrastructure is already built and available, advertising costs are minimal, and government-owned banks do not award their management extravagant bonuses or commissions that drain profits away. Rather, profits return to the government and the people. Profits also return to the government in another way: money that comes out from under mattresses and gets deposited in savings accounts can be used to purchase government bonds. In Japan, for example, Japan Post Bank is the holder of fully one-fifth of the national debt. The government has its own captive government lender, servicing the debt at low interest rates without risking the vagaries of the international bond market. Fully 95% of Japan’s national debt is held domestically in one way or another. That helps explain how Japan can have the worst debt-to-GDP ratio of any major country and still maintain its standing as the world’s largest creditor. If you owe the money to yourself, it’s not really a debt. Some Examples of Successful Public Postal BanksKiwibank:New Zealand’s profitable postal bank had a return on equity of 11.7% in the second half of 2011, with net profits almost trebling. It is the only New Zealand bank able to compete with the big four Australian banks that dominate the New Zealand financial sector. In fact, Kiwibank was set up for that purpose. When the New Zealand postal banks were instituted in 2002, it was not to save the post office but to save New Zealand families and small businesses from big-bank predators. By 2001, Australian mega-banks controlled some 80% of New Zealand’s retail banking. Profits went abroad and were maximized by closing less profitable branches, especially in rural areas. The result was to place hardships on many New Zealand families and small businesses. The New Zealand government decided to launch a state-owned bank that would compete with the Aussie banks. To keep costs low while still providing services in communities throughout New Zealand, the planning team opened bank branches in post offices, establishing Kiwibank as a subsidiary of the government-owned New Zealand Post. Suddenly, New Zealanders had a choice in banking. In an early version of the “move your money” campaign, 500,000 customers transferred their deposits to public postal banks in Kiwibank’s first five years—this in a country of only 4 million people. Kiwibank consistently earns the nation’s highest customer satisfaction ratings, forcing the Australia-owned banks to improve their service in order to compete. China’s state-owned Postal Savings Bureau:With the assistance of the People’s Bank of China (the central bank), China’s Postal Savings Bureau was re-established in 1986 after a 34-year lapse. As in New Zealand, savings deposits flooded in, showing an extraordinary growth rate of over 50% annually in the first half of the 1990s and over 24% annually in the second half. By 1998, postal savings accounted for 47% of China Post’s operating revenues; and 80% of China’s post offices provided postal savings services. The Postal Savings Bureau has served as a vital link in mobilizing income and profits from the private sector, providing credit that is available to finance local development. In 2007, the Postal Savings Bank of China was set up from the Postal Savings Bureau and established as a state-owned limited company, which continues to provide postal banking services. Japan Post Bank:By 2007, Japan Post was the largest holder of personal savings in the world, boasting combined assets for its savings bank and insurance arms of more than ¥380 trillion ($3.2 trillion). It was also the largest employer in Japan. As in China, Japan Post recaptures and mobilizes income from the private sector, funding the government at low interest rates and protecting the nation’s sovereign debt from raids by foreign speculators. Switzerland’s Swiss Post:Postal financial services are by far the most profitable activity of Swiss Post, which suffers heavy losses from its parcel delivery and only marginal profits from letter delivery operations. India’s Post Office Savings Bank (POSB):POSB is India’s largest banking institution and its oldest, having been established in the latter half of the 19th century following the success of the postal savings bank system in England. Operated by the government of India, it provides small savings banking and financial services. The Department of Posts is now seeking to expand these services by obtaining a license for the creation of a full-fledged bank that would offer full lending and investing services. Russia’s PochtaBank:Russia, too, is seeking to expand its post office services. The head of the highly successful state-owned Sberbank has stepped down to take on the task of revitalizing the Russian post office and create a post office bank. PochtaBank will operate in the Russian Post’s 40,000 local post offices. The post office will function as a banking institution and compete on equal footing not only with private banks but with Sberbank itself. Brazil’s ECT:Brazil instituted a postal banking system in 2002 on a public/private model, with the national postal service (ECT) forming a partnership with the largest private bank in the country (Bradesco) to provide financial services at post offices. The current partnership is with Bank of Brazil. ECT (also known as Correios) is one of the largest state-owned companies in Latin America, with an international service network reaching more than 220 countries worldwide. The U.S. Postal Savings System:The now-defunct U.S. Postal Savings System was also quite successful in its day. It was set up in 1911 to get money out of hiding, attract the savings of immigrants accustomed to saving at post offices in their native countries, provide safe depositories for people who had lost confidence in private banks, and furnish depositories that had longer hours and were more convenient for working people than private banks provided. The minimum deposit was $1 and the maximum was $2,500. The postal system paid two percent interest on deposits annually. It issued U.S. Postal Savings Bonds in various denominations that paid annual interest, as well as Postal Savings Certificates and domestic money orders. Savings in the system spurted to $1.2 billion during the 1930s and jumped again during World War II, peaking in 1947 at almost $3.4 billion. The U.S. Postal Savings System was shut down in 1967, not because it was inefficient but because it became unnecessary after the profitability of catering to the unbanked and underbanked became apparent to the private financial sector. Private banks then captured the market, raising their interest rates and offering the same governmental guarantees that the postal savings system had. Time to Revive the U.S. Postal Savings System?Today, the market of the unbanked and underbanked has grown again, including about one in four U.S. households, according to a 2009 FDIC survey. Without access to conventional financial services, people turnto an alternative banking market of bill pay, prepaid debit cards and check cashing services, as well as payday loans. The unbanked pay excessive fees for basic financial services, are susceptible to high-cost predatory lenders, and have trouble buying a home and other assets because they have little or no credit history. On average, a payday borrower pays back $800 for a $300 loan, with $500 purely going toward interest. Low income adults in the U.S spend over 5 billion dollars paying off fees and debt associated with predatory loans every year. People with access to banks are better able to resist these services and break the cycle of poverty. Another underserviced market is the rural population. In May, a move to shutter 3,700 low-revenue post offices was halted only by months of dissent from rural states and their lawmakers, who said the cost-cutting would hurt their communities. Banking services are also more limited for farmers, following the 2008 financial crisis. With shrinking resources for obtaining credit, family farmers and ranchers are finding it increasingly difficult to stay in their homes. Postal banking could be a win-win in these circumstances, providing jobs and income for the post office along with safe and inexpensive banking services for underserviced populations. Countries such as Russia and India are exploring full-fledged lending services through their post offices; but if lending to the underbanked seems too risky, a U.S. postal bank could follow the lead of Japan Post and use the credit generated from its deposits to buy safe and liquid government bonds. That could still make the bank a win-win-win, providing income for the post office, safe and inexpensive depository and checking services for the underbanked, and a reliable source of public funding for the government. Reprinted with permission. Ellen Brown is an attorney and president of the Public Banking Institute, http://PublicBankingInstitute.org. In Web of Debt, her latest of eleven books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her websites arehttp://WebofDebt.com and http://EllenBrown.com.  An agent and landlord in our office brought this very interesting article appearing in Barron's to our attention today. The long and short of the article is that the percentage of the population owning their own home has shrunk, will continue to shrink and will not rebound any time soon for a variety of reasons. Instead, there is a shift taking place from a home owner nation to a "Renter Nation." Here is a link to the article. What do you think? Do you intend to rent or buy in the next five years. Many "professionals" are making big bets on what your answer will be.  Everyone has been so busy and there has been so much going on that we may have been remiss in welcoming our newest classes of agents. Our apolgies! Please welcome the following to iMove's team: Andrew Akins, Jerry Narrera, Chanel Ellis, Ryan Keller, Chon Lemon, Tiana Mcgee, Peter Naiman, Alfiya Nigmatzyanova, Glenda Ortiz, Elena Stephens and Ryan Viloria. Please introduce yourself when you see a fresh face. To see the company's active roster visit: ioveChicago.com/agents. Welcome.  Edgewater Community Council is sponsoring the second annual "Chicago SandCastle Open" this Saturday from 10-3 at Osterman Beach at Lake Shore Drive and Hollywood. Are you a talented sandcastle builder? If so you could take home the $500 grand prize. Details Here. Sacramento (Possibly Chicago) Consider Using Power of Eminent Domain to Seize Underwater Mortgages8/11/2012

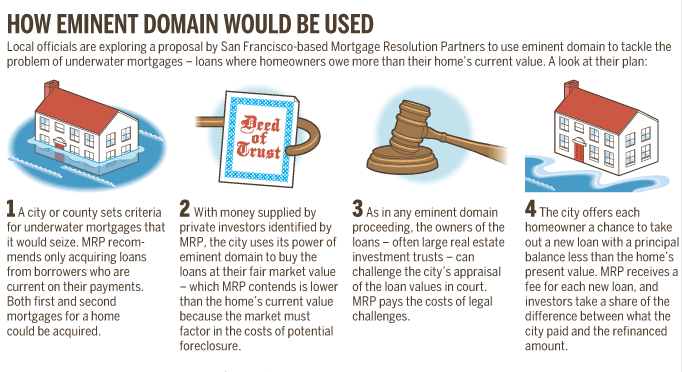

The Sacramento Bee reports that city leaders are considering using the city's power of eminent domain to seize underwater mortgages to provide relief to homeowners. The article suggests that Chicago may also be giving the idea some thought. This graphic contained in the article suggests how the program might work:

Spot these rims in Chicago and get $100... just email us at iMove Chicago (www.iMoveChicago.com) and tell us where and when you saw them. Exact location required to win. Happy hunting....follow us on facebook to get tips!

|

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media