|

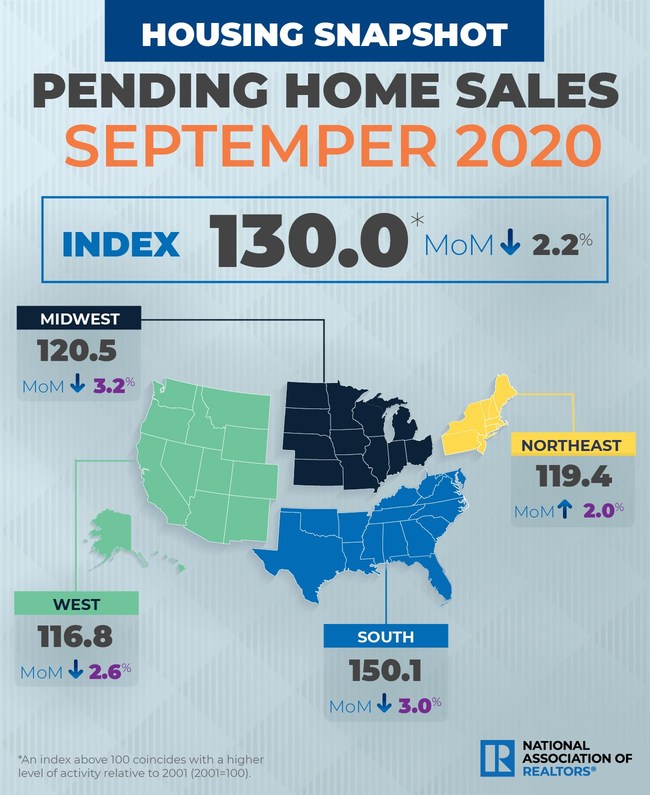

Pending home sales posted a slight monthly pullback in September after four straight months of contract activity growth.

Contract signings dipped 2.2% month over month to 130 in September, but were still 20.5% higher than the last year's reading, according to the National Association of Realtors' Pending Home Sales Index (PHSI). NAR Chief Economist Lawrence Yun said that, despite the decline, we're still likely to end the year with more homes sold overall in 2020 than in 2019. "With persistent low mortgage rates and some degree of a continuing jobs recovery, more contract signings are expected in the near future," he said. "Additionally, a second-order demand will steadily arise as homeowners who had not considered moving before the pandemic begin to enter the market. A number of these owners are contemplating moving into larger homes in less densely populated areas in light of new-found work-from-home flexibility." Pending home sales regional breakdown All four regions recorded significant year-over-year gains in September. On a month-over-month basis, only the Northeast posted decreases in contract activity. The Northeast PHSI rose 2% to 119.4 in September, up 27.7% from a year ago. In the Midwest, the index dropped 3.2% to 120.5 last month, but was up 18.5% from September 2019. Pending home sales in the South fell 3% to 150.1 in September, but were up 19.6% from September 2019. The index in the West declined 2.6% in September to 116.8, but was up 19.3% from a year ago.

0 Comments

The number of mortgages in active forbearance has ticked back up above 3 million, rising by 31,000 over the last week, according to new data from Black Knight.

The increase was driven by limited extension and removal activity and a jump in forbearance starts. There were 50,000 forbearance removals this week – the fewest of any week since the recovery began, according to Black Knight. The 89,000 extensions this week were the fewest in nine weeks. Meanwhile, some 33,000 new forbearance plans started over the past week. “In total, forbearance plan starts are up 15% in October compared to the month prior, with the rise driven by borrowers reactivating previously expired plans,” Black Knight said in an email to MPA. “New forbearance activations are down 7% from September, while reactivations are up 50%. This is most likely in reaction to the large volume of plans that were removed early in the month.” With 365,000 more forbearance plans still set to expire before November, there could be increased levels of extension and removal activity in the coming weeks, Black Knight said. As of Tuesday, approximately 5.7% of all active mortgages were in forbearance plans, up from 5.6% last week. Together, they represent $619 billion in unpaid principal. “Some 3.9% of all GSE-backed loans and 9.7% of all FHA/VA loans are currently in forbearance plans,” Black Knight said. “Another 5.7% of loans in private label securities or banks’ portfolios are also in forbearance.” Since last week, GSE forbearances have dropped by 1,000, while FHA loans in forbearance increased by 14,000. There was a jump of 18,000 among loans held in banks’ portfolios and private-label securities. Of the more than 3 million loans still in active forbearance, more than 80% have had their terms extended at some point since March, according to Black Knight. Overall mortgage fraud risk posted a sharp decline at the end of the second quarter of 2020, but purchase applications told a different story.

Record-low mortgage rates and the surge in refinance volume continued to push the overall fraud risk down. The CoreLogic Mortgage Application Fraud Risk Index showed a 26.3% year-over-year decrease at the end of the second quarter – marking the second year of substantial drop in risk. Throughout Q2 2020, CoreLogic estimated one in 164 mortgage applications, or 0.6% of all applications, contained indications of fraud. This figure was lower than the reported one in 123 mortgages or 0.8% in Q2 2019. However, risk in purchase applications grew by 6%, with investment properties driving the highest risk in both purchase and refinance segments. "The large drop in fraud risk in the past year was primarily driven by record-high refinancing, which is traditionally lower risk transactions," said Bridget Berg, principal of fraud solutions strategy for CoreLogic. "However, we still see elevated levels of risk in purchase transactions, and we have not yet seen the long-term impacts of the COVID-19 pandemic, so it's imperative risk managers remain vigilant in searching out potential fraud." Other key findings of the report:

Promontory MortgagePath announced an initiative today to support minority-owned financial institutions’ efforts to expand access to credit and homeownership in underserved communities.

Through the initiative, Promontory MortgagePath will partner with minority-owned depository institutions (MDIs) such as banks and credit unions, including community development financial institutions (CDFIs), to offer exclusive pricing, resources and joint marketing opportunities, the company said in an email to MPA. “The challenges facing community banks in low- to moderate-income areas will not be fixed immediately,” Promontory MortgagePath founder and CEO Gene Ludwig said. “But we must take action now to ensure that these vital institutions are supported, because when these institutions thrive, the positive impact on their communities is profound.” The initiative is meant to accelerate the ability of minority-owned banks to help their communities, the company said. There are more than 1,100 certified CDFIs in the US, managing about $222 billion in assets. Of the more than 5,400 federally insured financial institutions in the country, 149 are MDIs. “These institutions create jobs, increase access to affordable housing and expand financial opportunities for underserved communities,” Promontory MortgagePath said. A March study by the Urban Institute found that Black-owned banks generally lent in greater shares to low- and moderate-income communities. During the housing crisis, these banks increased their mortgage lending to Black borrowers while other financial institutions backed off. However, the same study found that Black-owned banks are disproportionately affected by financial crises. Promontory MortgagePath said that without access to cost-effective mortgage fulfillment technology, MDIs can be at a disadvantage relative to other financial institution. That also limits the wealth-building opportunities for the communities MDIs serve. A recent Federal Reserve study found that while homeowners possess a median net worth of $255,000, the median net worth for renters is only $6,300. As part of its new initiative, Promontory MortgagePath will work with the Community Development Bankers Association (CDBA) to identify strategic partners to participate. MDIs and CDFIs that join the initiative will have access to the company’s technology, US-based mortgage fulfillment services and joint marketing program at a steep discount. “MDIs and CDFIs play a vital role in expanding access to credit and building wealth in the communities they serve,” said Paul C. Katz, managing director and head of bank relations at Promontory MortgagePath. “Whether they are seeking to establish or grow their mortgage operations, Promontory MortgagePath is committed to partnering with these institutions to provide additional pathways to homeownership, and we highly encourage them to join the initiative.” The total number of mortgages in forbearance fell by two basis points from the prior week to 5.92% of servicers’ portfolio volume as of Oct. 18, according to new data from the Mortgage Bankers Association. According to the MBA’s estimate, 3 million homeowners are currently in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 20th week in a row, falling five basis points to 3.72%. The share of Ginnie Mae loans in forbearance increased three basis points to 8.17%, and the forbearance share for portfolio loans and private-label securities rose four basis points to 8.9%. The percentage of loans in forbearance for independent mortgage bank servicers rose two basis points to 6.35%, while the share of loans in forbearance for depository servicers fell seven basis points to 5.86%. “The share of loans in forbearance declined only slightly in the prior week, after two weeks of a flurry of borrowers exiting as they reached the six-month mark,” said Mike Farantoni, MBA senior vice president and chief economist. “There continues to be a steady improvement for Fannie Mae and Freddie Mac loans, but the forbearance share for Ginnie Mae, portfolio and PLS loans all increased. This is further evidence of the unevenness of the current economic recovery. The housing market is booming, as shown by the extremely strong pace of home sales last week. However, many homeowners continue to struggle, as the pace of the job market’s improvement has waned.” Sherrod Brown doesn’t seem to have a lot of faith in Kathy Kraninger.

The Ohio Democrat and ranking member of the Senate Banking Committee has repeatedly accused the director of the Consumer Financial Protection Bureau of putting corporations’ interests ahead of consumers and dropping the ball on mortgage relief awareness. He has also chastised her for reorganizing CFPB departments. Now Brown is calling on Kraninger to make sure the CFPB does more to prevent wrongful foreclosures in the wake of the COVID-19 pandemic. In June, the Mortgage Bankers Association estimated that 4.3 million homeowners were in forbearance programs as a result of the economic impacts of the pandemic. Many of those homeowners have begun to exit forbearance or are nearing the end of the first 180-day forbearance period provided for borrowers with federally backed mortgages under the CARES Act. In a letter to Kraninger, Brown said that the end of forbearance could result in a wave of improper foreclosures. “Some borrowers will be able to resume their regular payments by using the deferral or partial claim processes set up by Fannie Mae, Freddie Mac, FHA, or their private lender, in part because the [CFPB’s] June 2020 Interim Final Rule made changes in the servicing process to facilitate deferrals,” Brown wrote. “But other borrowers will be unable to resume their prior payments and will need more time to enter a modification with their servicer to make their payments more affordable.” However, the mortgage modification process can take time, and Brown worried that during that time, servicers “may already be putting borrowers on track for foreclosure.” “Under current rules, servicers can begin the foreclosure process when a borrower becomes 120 days delinquent,” Brown wrote. “While the CARES Act provides that servicers are not to report borrowers as delinquent to credit reporting agencies if the loan was current before entering forbearance, servicers and agencies backing federally-backed loans still consider borrowers delinquent for servicing purposes during forbearance under the CFPB’s servicing rules. As a result, at the end of the first 180-day forbearance period, a borrower could immediately be considered eligible for and a servicer could pursue foreclosure if the forbearance is not renewed.” While servicers are required to reach out to borrowers prior to initiating foreclosure proceedings, “those timelines may be shorter than the 120-day period that typically precedes a foreclosure,” Brown wrote. “In addition, if a servicer begins foreclosure prior to satisfying those requirements, a homeowner cannot rely on those rules to delay the foreclosure and seek assistance.” In addition, Brown said, the large number of borrowers servicers will need to contact within a short time frame may make it “difficult to ensure that outreach is timely, successful, and meets program requirements.” “It is unlikely that borrowers will understand how quickly foreclosure could begin,” Brown said. “If servicers begin the foreclosure process before the borrower has an opportunity to either extend their forbearance or be evaluated for an appropriate modification, it could add unnecessary costs for borrowers, make it harder to complete a request for assistance, and risk triggering foreclosures that could threaten families’ and neighborhoods’ recovery from the pandemic.” Brown asked Kraninger to arrange a staff briefing “to better understand what steps the CFPB will take to ensure that no borrower who is able to remain in their homes is improperly foreclosed upon or further financially burdened during this pandemic.” Borrowers’ FICO scores rose to new 2020 highs as interest rates slid to a new historic low in September, according to Ellie Mae.

Data from Ellie Mae's latest origination insight report showed that the 30-year note rate for VA loans fell to its lowest level, down to 2.78% from 2.86% month over month. Similarly, the 30-year rate on FHA loans fell from 3.10% to 3.01% in September, while conventional rates remained the highest overall at 3.02%. However, note rates for conventional loans were still down from 3.12% the month before. "We are continuing to see interest rates decrease to new historic lows, hovering right at three percent for the month for all loans," said Joe Tyrrell, president of ICE Mortgage Technology. "As we move into fall and the traditionally hot summer homebuying season normally tapers off, we will watch to see if purchase loan applications trend downward and refinances regain momentum. We know that homeowners are continuing to take advantage of the low rates, almost an entire percentage point lower than the same period in 2019, as a means to lower monthly payments and stretch their dollar." Of all closed loans, the share of refinances edged up to 58%, while purchase loans dipped back to 42%. With interest rates on a downtrend, Tyrrell said that mortgage lenders are tightening their standards through FICO scores. The average FICO score for all loans rose to a record high of 753, up one point from August. "We're seeing FICO scores rise to new 2020 highs, approximately 20 points higher than the same period in 2019, indicating that lenders are being more selective, but also that homebuyers and homeowners should understand the various loan products available to find the one that suits their profile best," Tyrrell said. Closing rates were down from 77.2% in August to 77.1 in September. The time to close all loans increased from 49 days to 51 days month over month. Time to close for purchase loans increased to 47 days in September, up from 45 days in August. Time to close for refinances increased to 54 days in September, up from 50 days in August. Several Senate Democrats on Wednesday introduced a bill that would prohibit financial institutions from discriminating against customers.

While the Civil Rights Act of 1964 outlawed discrimination in certain places of public accommodation, it does not include banks or other financial institutions. The new bill, the Fair Access to Financial Services Act, would prohibit financial institutions from discrimination in providing services on the basis of race, color, religion, national origin, sex, gender identity, or sexual orientation. The bill was introduced by senators Sherrod Brown (D-Ohio), Tina Smith (D-Minn.), Cory Booker (D-N.J.), Bob Menendez (D-N.J.), Elizabeth Warren (D-Mass.) and Chris Van Hollen (D-Md.). While the Fair Housing Act already makes it illegal to discriminate in lending, financial institutions have frequently been called on the carpet for doing just that. In recent years, several big banks, including Wells Fargo and JPMorgan Chase, have been accused of discriminating against minority borrowers – and Black borrowers pay an average of 13 basis points more for mortgages than white borrowers. All this comes as the homeownership gap between Black and white Americans is widening; at the end of 2019, the gap was larger than it was 50 years ago. However, borrowers who feel they are discriminated against often have little recourse due to the banking loophole in the Civil Rights Act, according to a 2019 New York Times report. The act lists specific businesses that may not discriminate against customers: movie theaters, restaurants, hotels, and performance and sports venues. Federal courts have found that because the act listed specific businesses, those not on that list – including financial institutions – aren’t bound by it. The new bill attempts to remedy that problem, Brown said. “Too many Black and brown Americans experience racial profiling and unequal treatment when trying to access services at banks and other financial institutions,” he said. “Victims of discrimination are not even able to hold financial institutions accountable. It is shameful. It is past time we pass legislation that explicitly outlaws discrimination in our nation’s financial system so that Black and brown people can have complete access to financial services free from harassment.” “When we talk about ending systemic racism and other institutionalized forms of discrimination in our society, we can’t ignore the economic inequalities that hold certain communities back,” Menendez said. “It is harder for communities of color and other minority groups to access our banking systems, open an account, secure credit, a small-business loan or a mortgage – barriers that cut people off from our financial system and make in nearly impossible to accumulate wealth. Our bill levels the playing field by making it illegal for financial institutions to discriminate simply on the basis of race, gender, orientation or religion.” On Friday, a day after the U.S. Department of Labor reported that the number of jobless claims for the previous week hit its highest level since August 22, the Mortgage Bankers Association’s Research Institute for Housing America released worrying third quarter data that says more than six million renters and homeowners missed their September payments.

According to RIHA, the percentage of homeowners and renters behind on their payments fell compared to Q2, when 11 percent (5.9 million) of renters missed, delayed, or reduced payments and eight percent (5.1 million) homeowners missed or deferred at least one mortgage payment. By September, 8.5 percent of renters and 7.1 percent of homeowners were behind on their payments. The improving numbers, while a welcome sign of stability, haven’t been enough to quell concerns around the country’s stubbornly elevated unemployment levels. “There is growing concern that absent a slowdown in the number of coronavirus cases and another round of much-needed federal aid, millions of households in the coming months face the prospect of falling further behind,” said Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University. Engelhardt added that when the Centers for Disease Control and Prevention’s current eviction moratorium expires in January, renters could be facing more dire circumstances. “Many renter households across the country could find themselves with no place to live and no means to repay missed payments,” he said. The study found that 40 percent – over 26 million – student debt borrowers also missed their September payments, a level of delinquency that has remained consistent since May. Engelhardt says the struggles of student loan holders could have negative implications for the housing and mortgage markets. “Borrowers ending up in default would see an adverse effect on their credit, in turn making it potentially more challenging for them to rent or qualify for a mortgage,” he said. Key findings Looking at the various data points provided by RIHA, it’s clear that mortgage-holders have fared better than renters and student debt borrowers during the COVID-19 pandemic. In April, three percent of mortgagors, renters and student debt borrowers were receiving unemployment insurance benefits. By the end of September, that figure had grown to seven percent for renters and eight percent for students. For homeowners, it remained unchanged. Student loan holders were found to be the most likely of the three groups to miss one or more payments. Just over 16 percent of them missed one payment over the second and third quarters of 2020, compared to 11 percent of renters and 4.7 percent of mortgagors, while 8.8 percent missed two payments, more than double the rate of renters and more than four times that of homeowners. Interestingly, the percentage of each group that missed four or more payments across Q2 and Q3 was actually higher than the percentage that missed three payments: 3.8 percent of renters, 4.2 percent of mortgagors and a relatively ungodly 22.7 percent of renters missed four payments or more in the two quarters. The missed payments are leaving gaping holes in balance sheets. RIHA estimates rental property owners lost up to $9.2 billion in Q3 revenue due to missed rent payments, while missed mortgage payments were calculated to be as high as $19.4 billion. Missed third quarter student loan payments were estimated to be in the neighborhood of $29.5 billion. Edward Seiler, RIHA’s executive director and MBA’s associate vice president of housing economics, says the financial distress laid out in the report “highlights the need for all stakeholders to come together to provide meaningful solutions to those who will need it most in the coming months.” Foreclosure activity hit record lows in the third quarter as COVID-19-related moratoria stalled filings, according to new data from ATTOM Data Solutions.

According to ATTOM’s Q3 2020 U.S. Foreclosure Market Report, there were 27,016 US properties with foreclosure filings – default notices, scheduled auctions or bank repossessions – in the third quarter. That’s down 12% from Q2 and down 81% year over year. Foreclosure filings in the third quarter were at their lowest level since ATTOM began tracking the data in the first quarter of 2008. The report also found that there were a total of 9,707 properties with foreclosure filings in September, down 2% from August and 80% year over year. “Foreclosure activity has, for all intents and purposes, ground to a halt due to moratoria put in place by the federal, state and local governments and the mortgage forbearance program initiated by the CARES Act,” said Rick Sharga, executive vice president of RealtyTrac, an ATTOM Data company. “But it’s important to remember that the numbers we’re seeing are artificially low, even as the number of seriously delinquent loans continues to increase, and that we’ll see a significant – and probably quite sudden – burst of foreclosure activity once these various government programs expire.” Foreclosure starts were also down nationwide. Lenders started the foreclosure process on 15,129 properties in Q3, a 15% drop from Q2 and an 81% drop year over year. Q3 marked the 21st consecutuive quarter with a year-over-year decrease in foreclosure starts. Pennsylvania posted the greatest decrease in foreclosure starts at 95%, followed by Wisconsin (93%), Washington state (93%), Maryland (91%) and Colorado (90%). Among Metro areas, Washington, D.C., say the biggest decrease in foreclosure starts at 91%, followed by Philadelphia (90%), Cleveland (89%), Denver (89%) and Baltimore (88%). States with the highest foreclosure rates in the third quarter included Delaware (one in every 3,482 housing units with a foreclosure filing), New Jersey (one in every 3,314), New Mexico (one in every 3,079), Illinois (one in every 3,031), and South Carolina (one in every 2,339). |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media