|

Buyers face challenges in the tight housing market.

Mortgage rates in the US soared for the second week in a row, reaching their highest level in three weeks, as reported by Bloomberg. The average rate for a 30-year fixed loan rose to 6.9%, up from last week’s 6.81%, according to Freddie Mac. Prospective buyers are grappling with a tough housing market in various parts of the US. Mortgage rates have been hovering near 7% in recent weeks, while housing prices continue to inch higher due to limited inventory. Fitch Ratings has recently downgraded US government debt, leading to higher yields on Treasuries, marking fresh highs for 2023. Meanwhile, the latest payroll data indicates strength in the economy. The mix of rising mortgage rates, escalating housing prices, and ongoing economic fluctuations poses challenges for those seeking to buy homes, particularly for first-time homebuyers attempting to break into the housing market. “The combination of upbeat economic data and the US government credit rating downgrade caused mortgage rates to rise this week,” said Sam Khater, chief economist at Freddie Mac, as quoted by Bloomberg.

0 Comments

Supply shortage and high prices deter international homebuyers.

Foreign investment in existing residential properties fell to its lowest level since 2009, the National Association of Realtors reported Tuesday. The number of existing homes sold to international buyers from April 2022 to March 2023 declined 14.2% to a record low of 84,600 units. Overall, annual foreign investment was down 9.6% to $53.3 billion. “Sharply lower housing inventory in the US and higher borrowing costs across the world have dented international buyers for two straight years,” NAR chief economist Lawrence Yun explained. The decline was notable among immigrants, who purchased $23.4 billion worth of existing homes. That’s down 31.4% from the prior year and represents 44% of the dollar volume of purchases. Meanwhile, foreign buyers who lived abroad purchased $29.9 billion worth of existing homes, up 20% and accounting for 56% of the dollar volume. International buyers made up 2.3% of the $2.3 trillion in existing-home sales during that period. According to NAR’s report, 50% of foreign buyers purchased their property for use as a vacation home, rental property, or both – up from 44% year over year. About 59% of international buyers purchased detached, single-family homes. Reflecting the burgeoning home prices during the period, the average and median purchase prices among international buyers soared to all-time highs of $639,900 and $396,400, respectively. Chinese buyers had the highest average purchase price, with a third (33%) purchasing property in California. In total, 15% of foreign buyers purchased properties worth more than $1 million from April 2022 to March 2023. Top five countries of origin by number of existing homes purchased:

“Home purchases from Chinese buyers increased after China relaxed the world’s strictest pandemic lockdown policy, while buyers from India were helped by the country’s strong GDP growth,” Yun said. “A stronger Mexican peso against the US dollar likely contributed to the rise in sales from Mexican buyers. Florida, Texas and Arizona continue to attract foreign buyers despite the hot weather conditions during the summer and the significant spike in home prices that began a few years ago.” Yun is also optimistic that recovering international travel following the end of the pandemic will bring more foreign transactions in the coming months and years. Another week brings a new low for purchase mortgage applications.

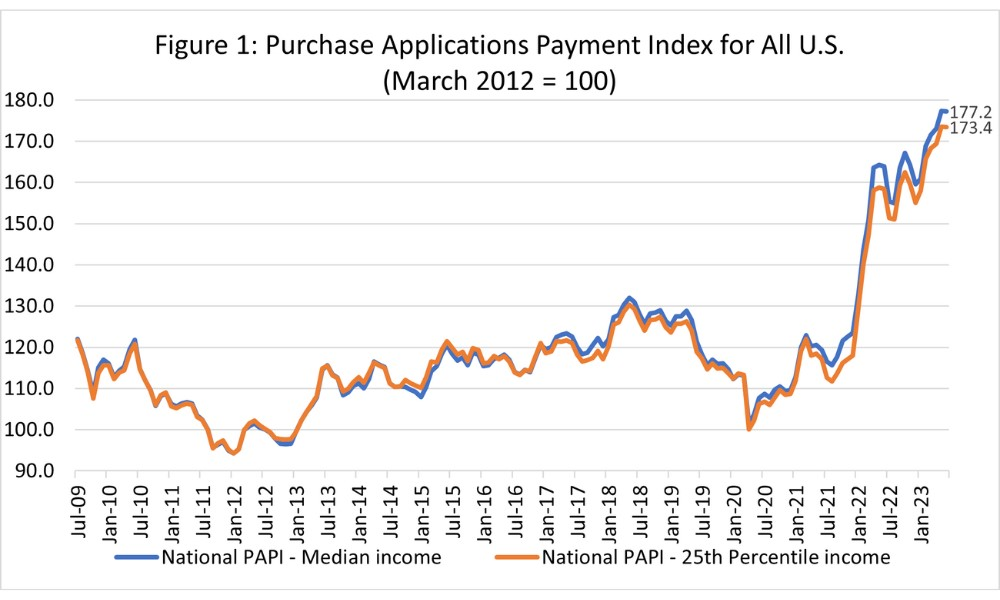

US mortgage applications fell for the second straight week, with purchase activity declining to its lowest level since June. The Market Composite Index – the Mortgage Bankers Association’s gauge of application volume – posted a 3% drop during the week ending July 28. Both refinance and purchase application volumes were also down 3% on a seasonally adjusted basis, driven by a six-basis point rise in the contract interest rate for 30-year mortgages. “Mortgage rates edged higher last week, with the 30-year fixed mortgage rate’s increase to 6.93% and leading to another decline in overall applications,” said Joel Kan, MBA’s deputy chief economist. “The decline in purchase activity was driven mainly by weaker conventional purchase application volume, as limited housing inventory and rates still close to 7% are crimping affordability for many potential homebuyers.” According to MBA’s Builder Application Survey, the median mortgage payment for purchase mortgages climbed from $2,515 in May to $2,520 in June. Of total applications, the refi share of mortgage activity remained flat at 28.9%, while the adjustable-rate mortgage (ARM) share of activity increased to 6.5%. “The refinance market continues to feel the impact of these higher rates, and applications trailed last year’s pace by over 30% with many homeowners not looking for refinance opportunities,” Kan said. Higher payment for purchase mortgages offsets gain in earnings. Mortgage payments in June remained relatively unaffordable for most homebuyers due to elevated rates and home prices, according to the Mortgage Bankers Association. MBA’s latest Purchase Applications Payment Index (PAPI) showed that borrower affordability was essentially flat in June, with the national median payment applied for by purchase applicants dropping 0.1% to $2,162. While the index decreased slightly, it remained at high levels. Payments spiked 14.2% year over year, offsetting the 5.7% annual gain in median earnings. Meanwhile, the national mortgage payment decreased slightly to $1,459 in June from $1,462 in May for borrowers applying for lower-payment mortgages (the 25th percentile).

“Homebuyer affordability is still strained this summer, with mortgage rates remaining high and volatile, and home prices high because of low inventory,” said Edward Seiler, associate vice president of housing economics at MBA. Seiler noted that the median purchase application amount fell from $330,000 to $326,000 in June, which he said is a “positive sign that home prices are stabilizing. An ongoing combination of flattening home prices and lower rates would offer reprieve for households who are looking to buy a home.” The new S&P CoreLogic home price index was up 0.7% nationally, continuing the slowdown of the last few months. The gains come as long-term mortgage rates hover around 6% to 7%. According to Freddie Mac, the 30-year fixed-rate loan averaged 6.78% as of July 27. |

|

- iMove Chicago

- Real Estate School

-

Laws

-

CRLTO

>

- 5-12-010 Title, Purpose And Scope.

- 5-12-020 Exclusions.

- 5-12-030 Definitions.

- 5-12-040 Tenant Responsibilities.

- 5-12-050 Landlord’s Right Of Access.

- 5-12-060 Remedies For Improper Denial Of Access.

- 5-12-070 Landlord’s Responsibility To Maintain.

- 5-12-080 Security Deposits.

- 5-12-081 Interest Rate On Security Deposits.

- 5-12-082 Interest Rate Notification.

- 5-12-090 Identification Of Owner And Agents.

- 5-12-095 Tenants’ Notification of Foreclosure Action.

- 5-12-100 Notice Of Conditions Affecting Habitability.

- 5-12-110 Tenant Remedies.

- 5-12-120 Subleases.

- 5-12-130 Landlord Remedies.

- 5-12-140 Rental Agreement.

- 5-12-150 Prohibition On Retaliatory Conduct By Landlord.

- 5-12-160 Prohibition On Interruption Of Tenant Occupancy By Landlord.

- 5-12-170 Summary Of Ordinance Attached To Rental Agreement.

- 5-12-180 Attorney’s Fees.

- 5-12-190 Rights And Remedies Under Other Laws.

- 5-12-200 Severability.

- Illinois Eviction Law (Forcible Entry And Detainer)

- Illinois Security Deposit Return Act

-

CRLTO

>

- Today's Cool Thing

- Social Media